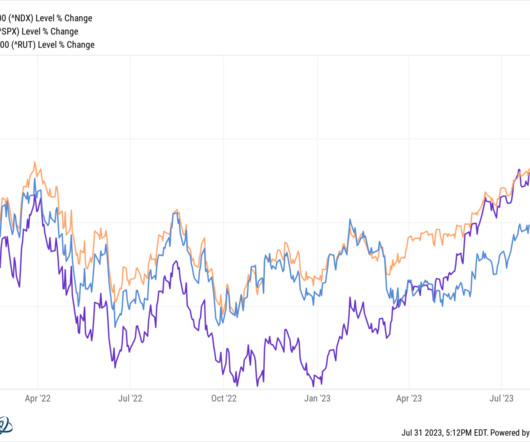

Round Trip

The Big Picture

AUGUST 1, 2023

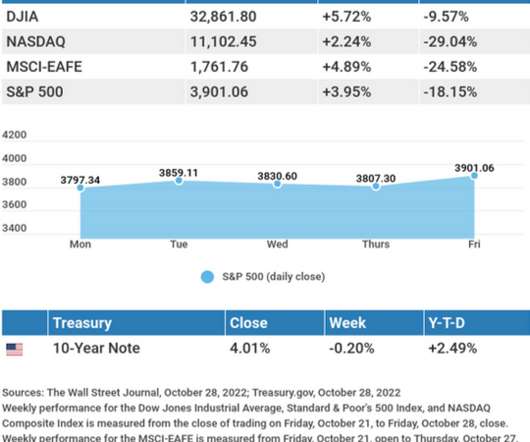

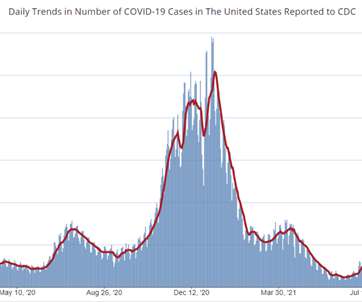

After a monstrous 68% recovery from the March 2020 pandemic low, and another nearly 30% gain in 2021, markets decided to have one of their all-too-regular spasms. Were you a late FOMO buyer in 2021? Recall John Kenneth Galbraith’s observation: “The only function of economic forecasting is to make astrology look respectable.”

Let's personalize your content