Key Tax Court Cases on Valuation of Pass-Through Entities: The Early Years

Wealth Management

JANUARY 30, 2024

Developments from 1999 through 2019.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JANUARY 30, 2024

Developments from 1999 through 2019.

The Big Picture

FEBRUARY 27, 2023

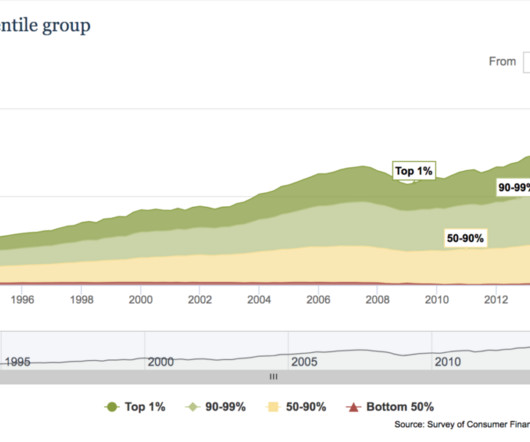

equity valuations: “Baby-boomers’ huge flow of 401K plan contributions helped to drive equities higher; now that ~70 million Boomers are retiring, when do demographics flip this from a huge positive to a net drag?” (aka The Hidden World of Failure ) (October 23, 2020) Stock Ownership : Distribution of Household Wealth in the U.S.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Protect What Matters: Rethinking Finance Ops In A Digital World

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Trade Brains

JUNE 24, 2025

completed its first tender offer, which granted early employees liquidity and pushed its private valuation past the $1 billion mark , officially earning unicorn status. With its $1 billion valuation now official and a game-changing partnership with Perplexity in play, Fireflies is transforming the digital landscape one meeting at a time.

Financial Symmetry

FEBRUARY 20, 2025

This means that the expansion of valuation multiples, like price-to-earnings (P/E), has played a big role.2 For current valuations to be justified for the Mag 7 and large growth stocks more broadly, very large earnings growth will have to continue. Pay attention to valuations. 2 Figure 4 demonstrates. Source: Morningstar.

Validea

SEPTEMBER 21, 2022

With the S&P 500 now close to 20% off its highs, I thought now might be a good time to look to our market valuation tool to see where things stand. But before I do that, I wanted to first cover two caveats I always put in articles about market valuation. With that all being said, let’s look at the current valuation data.

Validea

JUNE 23, 2025

The Gardners dubbed this the “Fool Ratio” and use it to identify growth stocks trading at reasonable valuations. Combining quality fundamentals, growth, insider conviction, and manageable valuations makes this a model with serious long-term appeal. Year Fool Portfolio S&P 500 +/- S&P 2003 (7/15/2003) 19.8%

Brown Advisory

FEBRUARY 15, 2019

Outlook for 2019 | The Measure of All Things. Fri, 02/15/2019 - 09:12. Entering 2019, we face rising economic, political and market risks. But the drop in valuations experienced at year’s end, alongside higher bond yields, offer a foundation for better long-term return expectations across most asset classes.

Brown Advisory

NOVEMBER 1, 2019

2019 Year-End Planning Letter. Fri, 11/01/2019 - 13:44. Each year’s gift tax annual exclusion expires at the end of that year; therefore clients who wish to use their 2019 exclusion amount should make annual exclusion gifts to all desired beneficiaries before December 31.

MarketWatch

JUNE 16, 2023

“While we continue to focus on operating more efficiently and driving substantial organic revenue growth in the United States, we will also look to prudently capitalize on compelling opportunities at attractive valuations, as is the case with PointsBet’s U.S. business,” said DraftKing’s CEO Jason Robins in a statement.

Trade Brains

JUNE 12, 2025

The valuation of his home is not published, but it reflects his status. Luxury Car Collection: Jay Shah’s passion for luxury vehicles is evident in his collection, which includes: Car Model Estimated Value (₹ Crore) Lamborghini Aventador 5.62 Rolls Royce Phantom 9.50 Ferrari 488 4.40 Bentley Mulsanne 5.56

Carson Wealth

APRIL 8, 2024

Pockets of attractive valuations exist despite above-average valuations in some high-profile areas of the market. For perspective, payroll growth averaged 166,000 in 2019. One important way to view valuations is through earnings of various asset classes relative to the broader market and their own history.

Trade Brains

OCTOBER 12, 2023

Particulars/ Financial Year 2019 2020 2021 2022 2023 CAGR (4 Years) KPIT Technologies - Revenue (Cr) 641.26 Particulars/ Financial Year 2019 2020 2021 2022 2023 Average (5 Years) KPIT Technologies - D/E 0.14 CAGR from 2019-2030 and would be a driving force for the expansion of the company. Tata Elxsi - Interest Coverage 418.73

Trade Brains

NOVEMBER 6, 2023

2019-20 3,080.52 Financial Year OPM (%) NPM (%) 2022-23 6.50% 2.66% 2021-22 2% -2.81% 2020-21 0.65% -6.21% 2019-20 8.72% 1.63% 2018-19 7.63% 3.93% Average (5 Years) 5.10% -0.16% Return Ratios Force has RoE 7.38% in FY23 as compared to -5.08 cr to a profit in FY23 of Rs.133.74 Earnings remain volatile till the volume stabilizes.

Carson Wealth

JUNE 17, 2024

There is a more cyclical element related to valuations, but over time the impact of valuations tends to average out to near flat. The most well-known valuation measure is the price-to-earnings ratio (P/E), which captures the amount investors are willing to pay for a dollar of current earnings as a kind of proxy for long-term earnings.

Trade Brains

JANUARY 21, 2024

2020 ₹129.03 ₹(0.13) 2019 ₹216.55 ₹88.67 Fiscal Year Operating Profit Margin (%) Net Profit Margin (%) 2023 12.19% 5.83% 2022 9.68% 4.21% 2021 10.68% 5.37% 2020 1.66% -0.11% 2019 5.51% 41.09% 5 Year Average 7.95% 11.28% Return Ratios Jupiter’s Return on Equity was at 16.24% in FY23, which increased by 869 Bps from 7.55% in FY22.

Trade Brains

JUNE 12, 2024

They will receive a direct stake in the new entity, along with an independent market-driven valuation. Previously the PE ratio of ITC in 2019 stood at 28.8, although it has been increasing through the years the valuation is still around the industry PE. Key Ratios 2023 2022 2021 2020 2019 P/E Ratio 24.83

Carson Wealth

OCTOBER 7, 2024

That’s higher than anything we saw between 2001 and 2019 (when it peaked at 80.4%). in 2019, 5.9% Since the end of 2019, the S&P 500 is up 92%. The prime-age employment population ratio was unchanged at 80.9% in September. In fact, consumer credit is up only 1.6% year over year as of the second quarter of 2024, versus 4.6%

Trade Brains

JANUARY 24, 2023

On multiple occasions, its debt resolution plans fell apart due to a valuation mismatch. Fiscal Year Operating revenue (Rs Cr) Net profit/ loss (Rs Cr) 2022 6,581 -177 2021 3,345 104 2020 2,973 -2,684 2019 5,025 -1,537 2018 8,334 -384 We read above that Suzlon was overleveraged. 2019 -5.98 -30.47 2019 -1.36 -0.30

MarketWatch

MAY 26, 2023

Kotowski said Hamilton Lane’s stock is trading roughly at where it was in 2020 despite about 58% growth in assets under management since the end of 2019. HLNE to outperform from perform, with a 12-18 month price target of $87 a share.

Mr. Money Mustache

FEBRUARY 25, 2025

S&P returns (including dividends) since 2019, graph by the excellent portfolio visualizer website. The value of the S&P 500 index of stocks, where most of us hopefully have a good chunk of our retirement savings stashed into index funds, is up about fifty seven percent in just the past two years. Now back to the stock market.

Trade Brains

NOVEMBER 24, 2023

Revenue grew from FY 2019 to FY 2023 at a CAGR of 20.11%. Net profits increased at a CAGR of 33.19% from FY 2019 to FY 2023. 2019-20 148.63 2019-20 0 12.14 Revenues and profits are increasing at the growth stage, and the high P/E commanding the current valuations will be justified by the company’s growth rate.

The Irrelevant Investor

JUNE 17, 2019

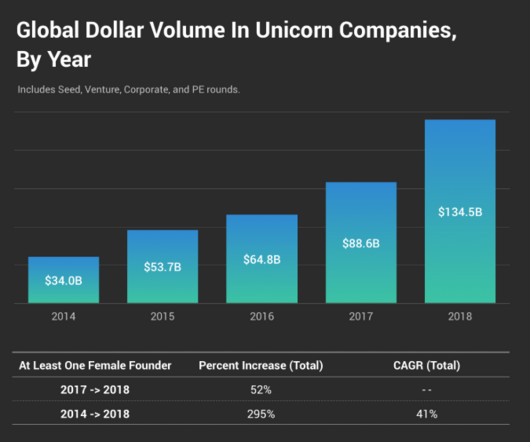

According to TechCrunch , 151 private companies around the world passed the $1 billion valuation mark in 2018. It's hard to imagine a world in which 2019 eclipses 2018. Collectively, they managed to raise a whopping $135 billion. Where do these unicorns go? Last year, 39 had initial public offerings and another 14 were acquired.

David Nelson

SEPTEMBER 26, 2022

Most valuation models start with the risk-free rate and as we’re learning this year, each stair step higher in the terminal rate has meant a stair step lower in equity multiples and stock prices. If history is any guide the launch will be well in advance of a turn in the economy. Investing is a combination of science and art.

Trade Brains

FEBRUARY 20, 2024

A closer look at the data reveals that revenue and profits fell in FY21, mainly due to a reduction in stock market valuations on account of the COVID-19 pandemic, which has impacted the valuation of the company’s investments and profitability. 2019 93.99 Fiscal Year Operating Profit Margin (%) Net Profit Margin (%) 2023 46.7

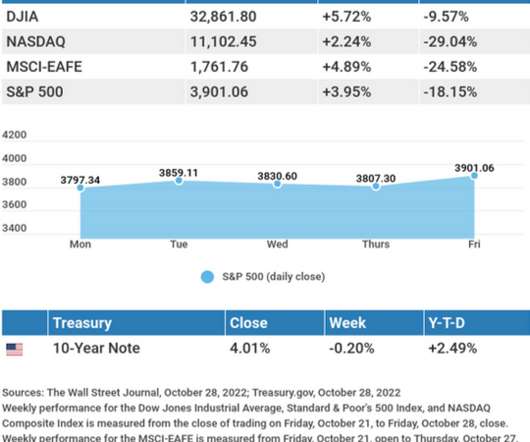

Cornerstone Financial Advisory

OCTOBER 31, 2022

Tip adapted Healthline, November 27, 2019 7. Healthline, November 27, 2019. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors. The Wall Street Journal, October 28, 2022.

Trade Brains

FEBRUARY 25, 2024

crore in FY22 on account of the higher fair valuation gain on investments in debt mutual funds. 2019-20 ₹ 75,660 ₹ 5,677.6 2019-20 0 53.04 Other income has increased to Rs. crore in FY23 from Rs. It forms more than 15% of net profit. Particulars/ Financial Year Revenue (Cr.) Net Profit (Cr.) 2020-21 ₹ 70,372 ₹ 4,389.1

Steve Sanduski

MAY 31, 2022

According to a 2019 study by J.D. Paul and I discuss: Why prospective buyers and sellers shouldn’t be relying on “industry standard” valuation metrics alone when considering an acquisition. Your business may not be for sale, but it should always be salable.

Trade Brains

MAY 24, 2023

2019 0 1,402.52 appears to be a fundamentally strong company with consistent revenue and growth, healthy profitability, and a reasonable valuation. Fiscal Year ROCE ROE 2023 51.41 34.63 (figures in %) Debt/Equity & Interest Coverage Fiscal year Debt/Equity Interest Coverage 2023 0 2,479.50 2022 0 2,160.23 2021 0 42,925.79

Trade Brains

JULY 14, 2022

2018 2019 2020 2021 2022. 2018 2019 2020 2021 2022. 2018 2019 2020 2021 2022. Tcs VS Infosys: How Does The Valuation Of The Company Look? Valuation Parameter (Rs in Cr). 2018 2019 2020 2021 2022. The revenue growth for Infosys was backed by its technology, energy, and utility business verticals. Infosys 31.48

Brown Advisory

MARCH 15, 2019

Fri, 03/15/2019 - 09:06. In 2018, industrial stocks had their second-worst year relative to the broad market in two decades, but so far in 2019, the sector has come back strongly. But in the early weeks of 2019, industrials were up more than 6% (as of 2/28/19), outpacing the broader market by a notable margin.

Truemind Capital

MAY 14, 2024

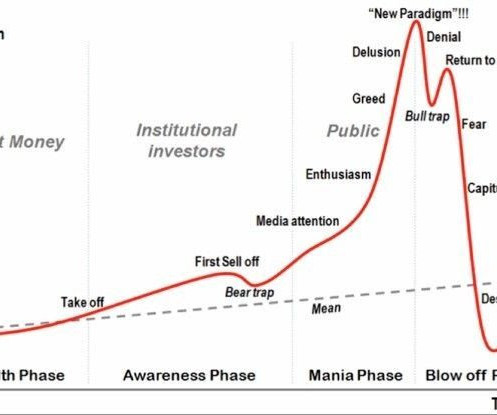

The problem is the level of valuations. Why is that so? Because it has been a popular narrative for quite some time. But, what’s the problem with investing in popular narratives? Popular investment sectors or themes gain momentum as more investors join, driving prices much higher than the worth of the underlying assets.

Brown Advisory

OCTOBER 18, 2019

Five Sources of Alpha in an Aging Market Cycle ajackson Fri, 10/18/2019 - 10:30 For the past decade, investors have enjoyed a long climb up the “wall of worry.” We know that equity valuations in the U.S. CURRENT VALUATION PREMIUMS, S&P 500 INDEX Metric Most Recent Long-Term Average Premium vs. Average Timeframe Trailing P/E 19.4

Brown Advisory

OCTOBER 18, 2019

Fri, 10/18/2019 - 10:30. We know that equity valuations in the U.S. CURRENT VALUATION PREMIUMS, S&P 500 INDEX. CBOE S&P 500 Implied Correlation Index, 1/1/2007-8/30/2019. Five Sources of Alpha in an Aging Market Cycle. For the past decade, investors have enjoyed a long climb up the “wall of worry.” Most Recent.

Trade Brains

JULY 11, 2022

2017 2018 2019 2020 2021. 2017 2018 2019 2020 2021. Emami Vs Dabur India – Valuation of the company. The PE ratio of a company shows the valuation of a company and is used for comparison with its peers. Valuation Parameter. 2018 2019 2020 2021 2022. Dabur India earned a net profit of Rs 1,693.30

Trade Brains

JANUARY 10, 2024

By 2033, the market is projected to reach a valuation of $5,541.8 Crores): Fiscal Year Berger Paints Indigo Paints 2019 6,062 535.62 Fiscal Year Berger Paints Indigo Paints 2019 494 26.87 The construction chemicals market in India is currently valued at $1,617.8 Figures in Rs. 2020 6,366 624.79 2021 6,818 723.32 2022 8,762 905.97

Zoe Financial

JULY 17, 2023

25% rally over the last 9 months for stocks, mainly driven by valuation expansion. Best Online Financial Advisor 2022 Series A Led by Softbank Most Innovative Companies 2022 2019 Annual Fintech Competition Winner Featured by: The post Market Drama appeared first on Zoe Financial. Nasdaq was up 3.3%. Up 35% year-to-date.

Trade Brains

APRIL 24, 2023

The share price of a company has nothing to do with the company’s valuation. The company’s main activity was manufacturing and delivering industrial gases, which was phased down on August 1, 2019. About 173 stocks have given over 10 times the returns between January 2001 and December 2019. Bombay Oxygen (Rs.

Validea

OCTOBER 5, 2022

Two weeks ago, I wrote an article where I looked at the valuation of the median stock and how it has changed over time. 12/31/2019 4.6% 12/31/2019 53.5% By Jack Forehand, CFA, CFP® ( @practicalquant ) —. Year End Date Negative Earner Percentage 12/30/2005 1.1% 12/29/2006 1.2% 12/31/2007 1.0% 12/31/2008 2.1% 12/31/2009 4.9%

MarketWatch

FEBRUARY 16, 2023

H reported Thursday fourth-quarter profit that beat expectations by a wide margin, boosted by a noncash benefit of $250 million from the release of a valuation allowance on deferred taxes. for 2022, when compared with pre-pandemic 2019 levels. Hyatt Hotels Corp. Net income of $294 million, or $2.69 Total revenue of $1.59

The Irrelevant Investor

JANUARY 5, 2022

When Zoom went public in 2019, XOM was 21x the size. billion pre-money valuation. It's trading at the same spot it was in December 2019, prior to the pandemic. In December 2019 its PS ratio was 7. And then, for one brief moment during the pandemic, Zoom took the lead. After the recent growth crash, Exxon is now 5.5x

Trade Brains

DECEMBER 18, 2022

A key acquisition was of Comstar Automotive Technologies in 2019. However, the figures before FY20 are not comparable with the ones thereafter at their face value because Sona BLW and Comstar Automotive were merged in FY 2019-20. The company has grown organically and inorganically over the years into a global producer. 2021 1,566.3

Trade Brains

MARCH 1, 2024

2019 ₹1,066.34 ₹47.98 Fiscal Year Operating Profit Margin (%) Net Profit Margin (%) 2023 11.24% 3.61% 2022 15.98% 7.84% 2021 22.51% 10.66% 2020 15.94% 6.82% 2019 11.56% 4.67% 5 Year Average 15.45% 6.72% Return Ratios Genus Power Infrastructure reported an ROE of 3.06% in FY23, halving its FY22 ROE from 6.27% in FY22. 2022 ₹744.42 ₹57.45

The Irrelevant Investor

JUNE 23, 2017

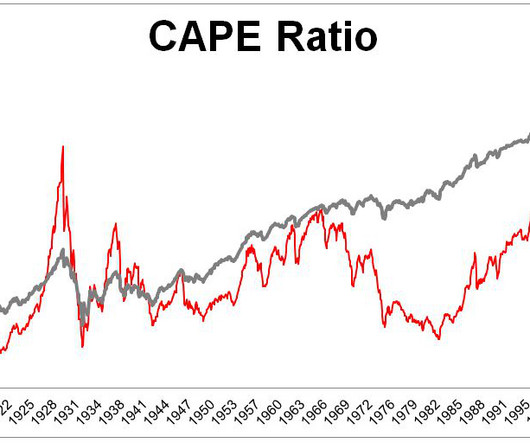

This visual tells a lot of stories, but for the purposes of this exercise, I want to focus on the two previous valuation spikes in red, which were followed by two stock market crashes in gray. If 2000 was fool me once and 2008 was fool me twice, what would 2019 be? The chart below shows the CAPE ratio and the S&P 500 (log).

Trade Brains

FEBRUARY 8, 2023

Year 2018 2019 2020 2021 2022 Total Income (in Crores) ₹1,658.46 ₹1,748.49 ₹1,731.72 ₹1,981.83 ₹2,300.69 Credit rating agencies generally trade at steep valuations on the back of an oligopolistic market, the asset-light nature of the business, limited capex requirement, and strong operating cash flows. Market Cap (₹ in Cr) 72,438.62

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content