IRS Criminal Investigation Unit Is Taking on More Crypto Tax Cases

Wealth Management

DECEMBER 4, 2023

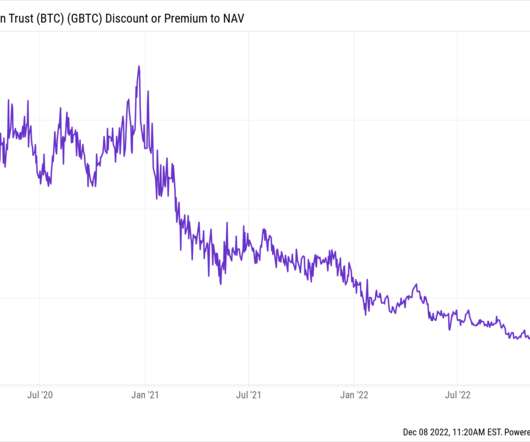

The IRS has been asking individuals to disclose if they've transacted in cryptocurrency since the 2019 tax year.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

DECEMBER 4, 2023

The IRS has been asking individuals to disclose if they've transacted in cryptocurrency since the 2019 tax year.

Wealth Management

JANUARY 30, 2024

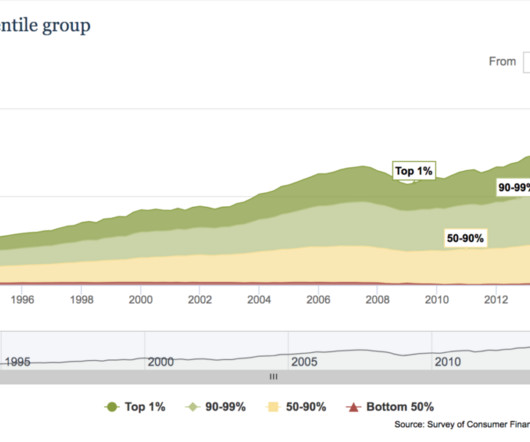

Developments from 1999 through 2019.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Calculated Risk

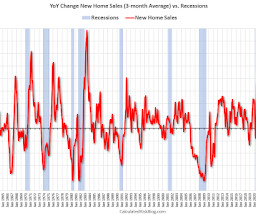

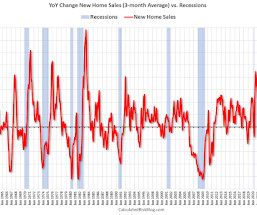

MAY 5, 2025

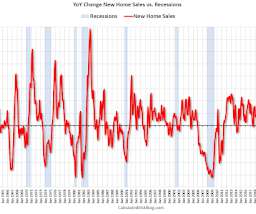

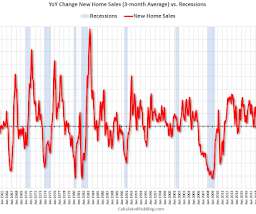

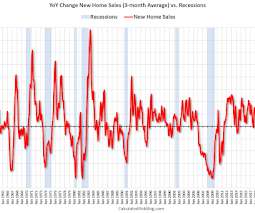

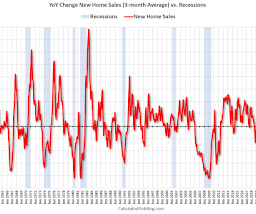

Also note that the sharp decline in 2010 was related to the housing tax credit policy in 2009 - and was just a continuation of the housing bust. I dismissed it when the yield curve inverted in 2019 and again in 2022. I ignored that downturn as a pandemic distortion. Yield Curve: The yield curve is a commonly used leading indicator.

Calculated Risk

APRIL 7, 2025

Also note that the sharp decline in 2010 was related to the housing tax credit policy in 2009 - and was just a continuation of the housing bust. I dismissed it when the yield curve inverted in 2019 and again in 2022. I ignored that downturn as a pandemic distortion. Yield Curve: The yield curve is a commonly used leading indicator.

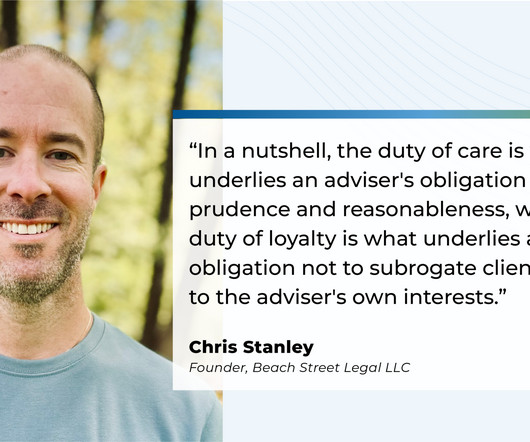

Nerd's Eye View

NOVEMBER 20, 2024

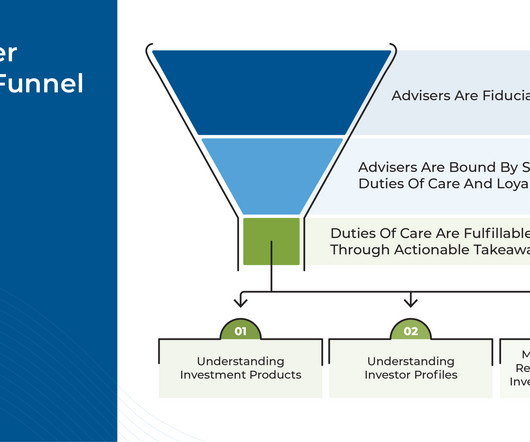

Notably, much of the language from the 1986 SEC Interpretive Release was later reiterated in a 2018 SEC Risk Alert and a 2019 SEC Interpretation. The SEC, in its interpretive release, sets an expectation of "periodic and systematic evaluation" (i.e.,

Wealth Management

JUNE 27, 2025

Michael was instrumental during AssetMark’s leveraged buyout transition to Genstar in 2013, its sale to Huatai Securities in 2016, its IPO in 2019, and its sale to GTCR in 2024. Before joining AssetMark, Michael was a Senior Vice President at Fidelity’s Institutional Wealth Services.

Calculated Risk

JUNE 9, 2025

Also note that the sharp decline in 2010 was related to the housing tax credit policy in 2009 - and was just a continuation of the housing bust. I dismissed it when the yield curve inverted in 2019 and again in 2022. I ignored that downturn as a pandemic distortion. Yield Curve: The yield curve is a commonly used leading indicator.

The Big Picture

FEBRUARY 27, 2023

This demographic cohort is simply not a seller due to retirement – the tax expenses would be too great. Estate taxes are why appreciated equity is transferred this way. I suspect most of us have a distorted viewpoint of the average investor versus the total capital in the market.

Nerd's Eye View

OCTOBER 27, 2023

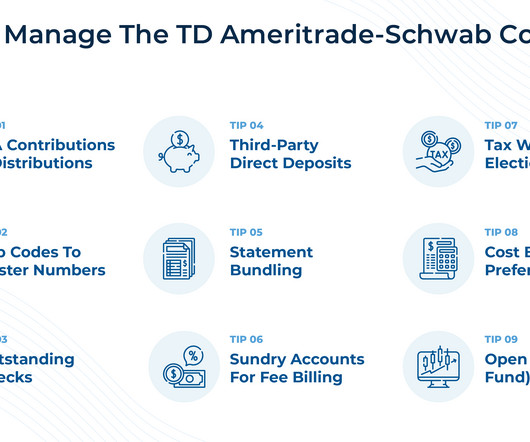

Also in industry news this week: A survey indicates that while financial advisors remain the most trusted source of financial advice, they might increasingly encounter client questions and ideas that originated from social media Following the transition of advisors and clients from TD Ameritrade and amid competition from competing RIA custodians, Charles (..)

The Big Picture

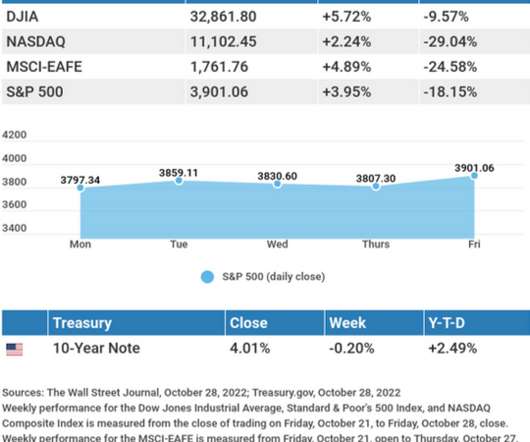

JULY 27, 2022

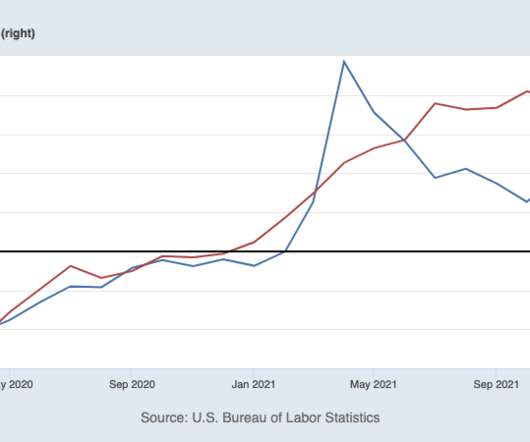

Consider these columns going back to 2013 pointing out the foolishness of tax-payer subsidized corporate welfare queens (2013), and why median wages were rising ( 2016 , 2017 , 2018 , 2018 , 2019 ). Then came the pandemic, and a huge federal worker subsidy. Workers upskilled and launched new businesses.

Nerd's Eye View

APRIL 21, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that in a settlement with the SEC, robo-advisor platform Betterment agreed to pay a $9 million penalty for allegedly misstating the frequency that its automated tax-loss harvesting system was scanning some client accounts between (..)

The Big Picture

OCTOBER 23, 2023

Your grandchildren will blame the toxic combination of incompetency and ideology for the massively increased carrying costs of unfunded spending and tax cuts. Note that we undertook much of the work anyway (airports, electrical grid, roads, etc.), just decades later at a much greater cost. All simply unnecessary.

Abnormal Returns

DECEMBER 8, 2022

morningstar.com) Strategy Six year-end financial moves to consider including 'tax loss harvesting.' youngmoney.co) Why we can never go back to 2019. Markets U.S. gasoline prices are below where they were a year ago. nytimes.com) Checking in on the state of the muni bond market. kyla.substack.com) Americans are getting lonelier.

The Big Picture

SEPTEMBER 29, 2022

to 6% yield or better (according to Bankrate’s Tax Equivalent Yield Calculator ). Despite what you may have heard, the Fed isn’t the only factor driving equity markets. However, they are significant — and rising rates this year have been a headwind for both equities and the economy.

Calculated Risk

SEPTEMBER 16, 2022

See my post in 2019: Don't Freak Out about the Yield Curve ) For the economy, what I focus on is single family starts and new home sales. Also note that the sharp decline in 2010 was related to the housing tax credit policy in 2009 - and was just a continuation of the housing bust. I ignored that pandemic distortion.

Good Financial Cents

JANUARY 19, 2023

A major decision in retirement planning is whether to make pre-tax or Roth (after-tax) 401k contributions. Pre-tax contributions go into your retirement account with money that has not been taxed, and then taxes will be paid when the funds are withdrawn in retirement.

Nerd's Eye View

AUGUST 28, 2023

The announcement of the merger between Charles Schwab and TD Ameritrade in November 2019 kicked off a marathon of preparation for advisory firms to transition their clients on the TD Ameritrade custodial platform to Schwab.

Calculated Risk

DECEMBER 7, 2022

See my post in 2019: Don't Freak Out about the Yield Curve ) For the economy, what I focus on is single family starts and new home sales. Also note that the sharp decline in 2010 was related to the housing tax credit policy in 2009 - and was just a continuation of the housing bust. I ignored that pandemic distortion.

Wealth Management

JULY 10, 2025

We took a pause in the last year to acknowledge that, since our formation in 2019 , we have tripled in size and integrated more than nine firms. It has been an exciting time. We’ve just passed $30 billion in AUM. We have 375-plus employees and 26 offices as of today. formally launched Wealthspire 2.0 in summer 2024.

Nerd's Eye View

OCTOBER 25, 2023

In 2019, the SEC released a Commission Interpretation that separated the obligation of RIAs to act in their clients' best interests into separate duties of care (to provide investment advice in the best interest of the client) and loyalty (to eliminate or disclose all potential conflicts of interest with the client).

The Big Picture

DECEMBER 11, 2023

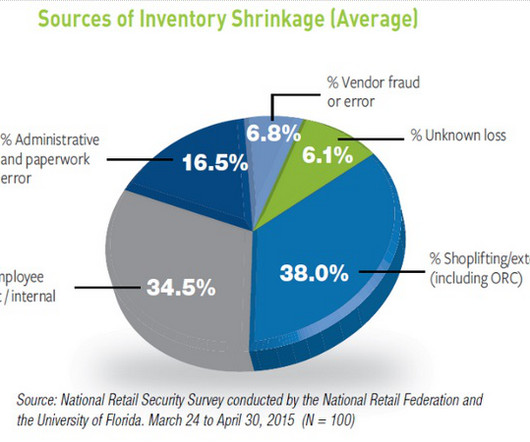

billion in 2019, according to the state agency that tracks sales tax. Rachel Michelin, president of the California Retailers Assn., told the San Jose Mercury News that in San Francisco and Oakland alone, businesses lose $3.6 billion to organized retail crime each year. Can that be right? In a word: no.”

The Big Picture

JUNE 9, 2025

If they don’t know your zip code or tax bracket, how on earth is their advice geared to your circumstances? If you want to learn more about it, see “ The Kidnapping of Little Charley Ross ,” Library of Congress, April 23, 2019. Of course it is not. The post Never Take Candy from Strangers appeared first on The Big Picture.

The Chicago Financial Planner

OCTOBER 21, 2021

This is up from $285,000 in 2019, from $275,000 in 2017 and from $220,000 in 2014. The money goes into the account on a pre-tax basis much like a traditional 401(k) or IRA. This is a great opportunity for those who earn too much to make pre-tax contributions to a traditional IRA. The rising cost of healthcare in retirement .

Carson Wealth

NOVEMBER 3, 2022

And while the holidays are traditionally a time to reflect on our blessings and help those less fortunate than ourselves, there’s another factor influencing the timing of these donations — and that’s the goal of minimizing a tax bill. Three Tax-Advantaged Donation Strategies to Consider. Create a donor-advised fund (DAF).

The Big Picture

MARCH 21, 2023

Bloomberg ) see also In New York City, a $100,000 Salary Feels Like $36,000 : After taxes and adjusting for the sky-high cost of living, a six-figure paycheck doesn’t take you as far as you might expect. In the United States alone, individuals donated close to $300 billion to charity in 2019.

Trade Brains

JULY 9, 2025

The Consumer Price Index (CPI)-based inflation eased to 2.82% in May 2025, down from 3.16% in April 2025, marking the lowest reading since February 2019. Use tax-efficient tools like NPS, ELSS, PPF for compounding and tax savings. More recently, the annual inflation rate in India was recorded at 6.95% in 2023. over that period.

Calculated Risk

JANUARY 13, 2023

Also note that the sharp decline in 2010 was related to the housing tax credit policy in 2009 - and was just a continuation of the housing bust. Another exception was in late 2021 - we saw a significant YoY decline in new home sales related to the pandemic and the surge in new home sales in the second half of 2020. 2008 0.1% -2.5% 2009 -2.6%

Steve Feinberg

JUNE 25, 2021

The American Rescue plan signed in March, 2021 requires the IRS to pay out ½ of enhanced Child Tax Credits (CTC) to eligible taxpayers beginning this month. One to help ensure you will get your Child Tax Credit if you are a non-filer and a second one to opt out of the monthly payments. Last year your tax return credit was $4,000.

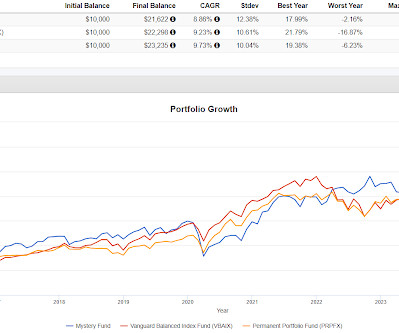

Random Roger's Retirement Planning

NOVEMBER 4, 2024

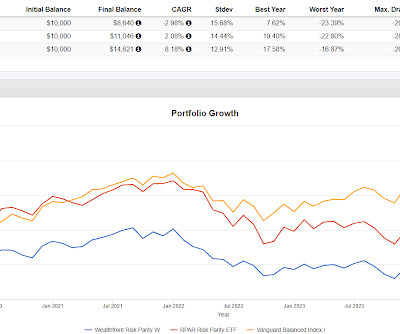

WFRPX did well in 2019 but lagged VBAIX by a lot in every other year of its existence. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Before then, RPAR tracked VBAIX pretty closely.

Carson Wealth

DECEMBER 9, 2024

Optimism over lower taxes, a stronger economy, animal spirits, and strong earnings all were likely reasons for the surge. For reference, the 2019 average was 166,000. 6 million level we saw in 2018-2019. million level we saw in 2018-2019. The other aspect that is concerning is that overall hiring has slowed, a lot.

Harness Wealth

APRIL 15, 2025

Thats because wealth at the upper end tends to be built not just through income, but through equity ownership, business interests, long-term investing, and real estate gains, assets that benefit from compounding, appreciation, and favorable tax treatment over time. Tax related products and services provided through Harness Tax LLC.

Random Roger's Retirement Planning

FEBRUARY 9, 2025

If someone bought the Mystery Fund in late 2019, they wouldn't have been chasing heat even but a year later there probably would have been a ton of regret. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

Getting Your Financial Ducks In A Row

OCTOBER 17, 2022

This original IRA was not deductible from income for tax purposes, and the annual contribution limit was the lesser of $1,500 or 15% of household income. The Economic Recovery Tax Act (ERTA) of 1981 allowed for the IRA to become universally available as a savings incentive to all workers under age 70 1/2. billion by 1981.

Darrow Wealth Management

DECEMBER 23, 2022

Congress is once again poised to make sweeping changes to the retirement and tax rules in the last two weeks of the year. After the passing of the original Secure Act in 2019 , lawmakers have been working on enacting more changes. would, for the second time since 2019, increase the RMD age. The Secure Act 2.0 retirement changes.

Harness Wealth

MARCH 29, 2023

Below are some insights from Richard Morris, Executive Vice President and Director of Tax Services, and Alex Seleznev, Senior Investment Advisor and Chief Operating Officer of MBI, LLC. And depending on your specific tax situation, you may be paying between 15% and 20% or even more in capital gain taxes.

Darrow Wealth Management

NOVEMBER 4, 2024

In 2019, the CFP board announced CFP® professionals must adhere to a fiduciary duty when providing investment advice. If you’re working with a CPA for your taxes or have an estate planning attorney, consider asking them for a recommendation also. Personal referrals are especially helpful to get a sense of fees and services.

Zoe Financial

APRIL 23, 2023

Stay tuned for next week. – Andres Disclosure: This page is not investment advice and should not be relied on for such advice or as a substitute for consultation with professional accounting, tax, legal or financial advisors. The observations of industry trends should not be read as recommendations for stocks or sectors.

Nationwide Financial

JUNE 9, 2023

Key Takeaways: The last two years have been marked by the highest inflation rates in decades; your clients saving for retirement can use this to their advantage through short-term investments, tax deferral, and insurance products offering better benefits. This can mean an unexpected tax liability for the uninitiated.

Calculated Risk

JANUARY 10, 2024

Also note that the sharp decline in 2010 was related to the housing tax credit policy in 2009 - and was just a continuation of the housing bust. Another exception was in late 2021 - we saw a significant YoY decline in new home sales related to the pandemic and the surge in new home sales in the second half of 2020. 2008 0.1% -2.5% 2009 -2.6%

Good Financial Cents

JANUARY 24, 2023

In the normal course, you don’t even need to file any additional tax or reporting documents with the IRS. But that distinction was eliminated for tax years beginning in 2020 and beyond. Tax-deferral of Investment Earnings Both a Roth IRA and a traditional IRA enable your funds to accumulate investment income on a tax-deferred basis.

Trade Brains

NOVEMBER 17, 2023

2019-20 5.68 -3.18 Net Profit Margin is fluctuating due to changes in the interest and tax payments as the company business was subdued in the initial days. However, with an exponential growth in Net profits, CAGR growth cannot be compared. Financial Year Revenue (Cr.) Net Profit (Cr.) 2022-23 350.96 2021-22 161.5 2020-21 12.98 -2.37

Cornerstone Financial Advisory

OCTOBER 31, 2022

Did you know that the IRS has an app that makes it easy to check some things off your tax to-do list? Free File is a tax prep software for taxpayers whose 2021 total adjusted gross income was $73,000 or less. Find payment options, including IRS Direct Pay which allows you to pay tax bills directly from your bank account.

Random Roger's Retirement Planning

APRIL 27, 2025

From March 9, 2009 through December 31, 2019 equities were up more than 498% and bonds returned 54% while cash alternatives realized little return. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Um ok, I mean who wouldn't want that?

Good Financial Cents

APRIL 1, 2023

That will give you a combined contribution of $13,000, which will also be fully tax-deductible. In theory, the purpose is to exhaust the plan within your lifetime, providing the IRS with its expected tax revenue. If either of you are, tax deductibility may be either limited or eliminated completely. Ads by Money.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content