When, Where, and for How Long

The Big Picture

APRIL 24, 2023

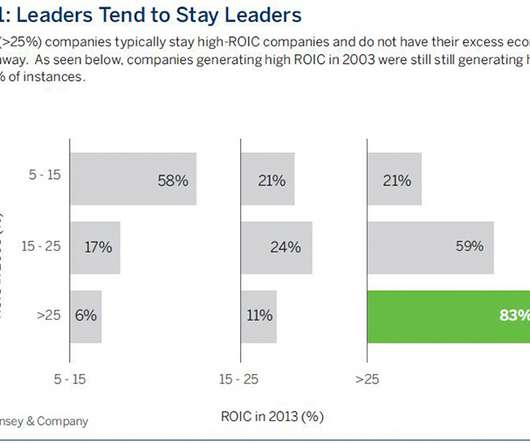

They all have different sensitivities to economic factors like trade, inflation, commodities, and growth. ” A Secular Bull Market is an extended period of time (10-20 years) driven by broad economic shifts that create an environment conducive to increasing corporate revenue and earnings.

Let's personalize your content