Equity Beat: The Long and Short

Brown Advisory

MARCH 14, 2023

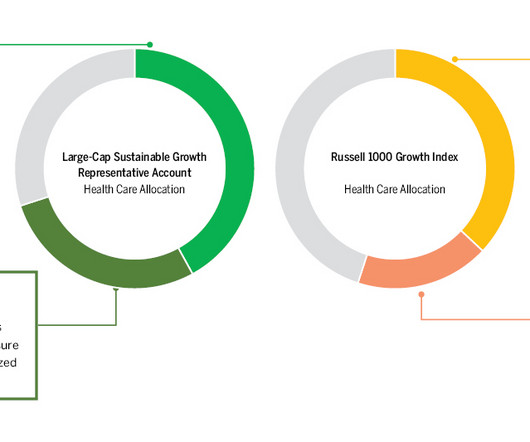

Still, even if the numbers aren’t moving, the sentiment is somewhat less favorable today than it was in November. Gary became CEO in 2010, and by 2014 he realized that his sales team needed to change its approach. Russell does not promote, sponsor or endorse the content of this communication. Source: FactSet.

Let's personalize your content