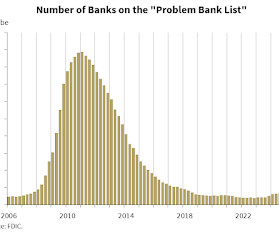

FDIC: Commercial Real Estate "Past-Due and nonaccrual" Highest Since 2014

Calculated Risk

MAY 28, 2025

The banking industry reported an aggregate return on assets of 1.16 Asset Quality Metrics Remained Generally Favorable, Though Weakness in Certain Portfolios Persisted Past-due and nonaccrual (PDNA) loans, or loans that are 30 or more days past due or in nonaccrual status, fell 1 basis point from the prior quarter to 1.59 billion (5.8

Let's personalize your content