Reading the volatility tea leaves

Nationwide Financial

OCTOBER 26, 2022

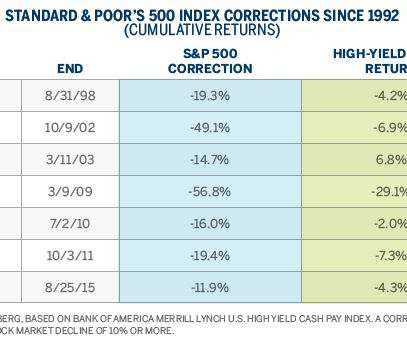

In times of peaking pessimism and extreme bearishness, investors often try to parse how the financial markets are reflecting an array of risks. However, how might the market reflect its trepidations when trying to digest those risks? This behavior is like what was seen near the bottom in 2002, 2009, and 2020.

Let's personalize your content