No Pain, No Gain

Investing Caffeine

MAY 2, 2022

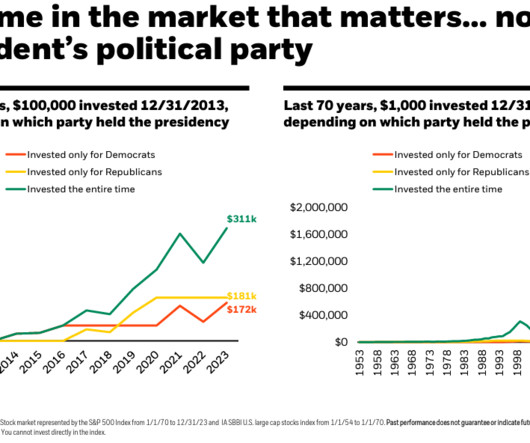

For long-term stock investors who have reaped the massive +520% rewards from the March 2009 lows, they understand this gargantuan climb was not earned without some rocky times along the way. As Albert Einstein stated, “In the middle of every difficulty lies an opportunity.”.

Let's personalize your content