Midyear Outlook 2022 | Navigating Turbulence | July 12, 2022

James Hendries

JULY 13, 2022

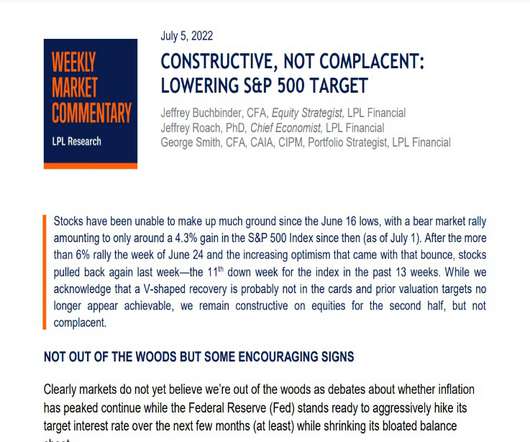

So far, this year hasn’t seen a full-blown crisis like 2008–2009 or 2020, but the ride has been very bumpy. Understandably, rising prices, slowing economic growth, and a challenging first half for both stocks and bonds have many investors on edge, and fatigue from more than two years of COVID-19 measures doesn’t make it any easier.

Let's personalize your content