What Else Might be Driving Sentiment?

The Big Picture

OCTOBER 19, 2023

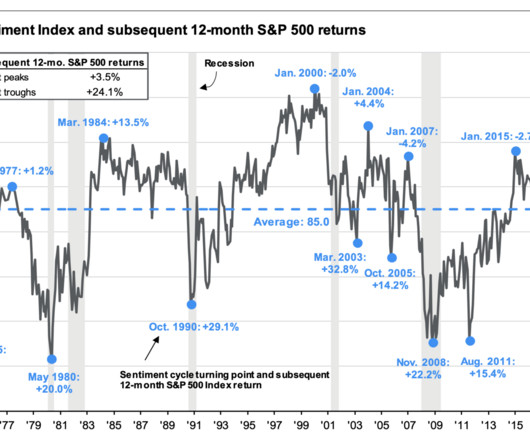

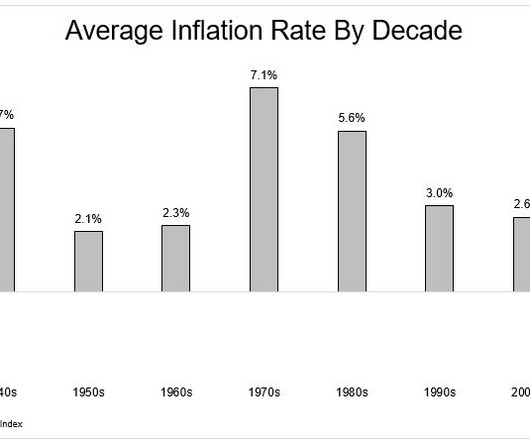

I run through 30 charts in 30 minutes that explain where we are in the economic cycle, what markets are doing, and what it means to their portfolios. The economy is not on the right track, even as Americans’ Net Worth Surged by Most in Decades During Pandemic. 2007-09 Great Financial Crisis 7. This quarter, it was Sentiment.

Let's personalize your content