Perils of Investing in Popular Narratives

Truemind Capital

MAY 14, 2024

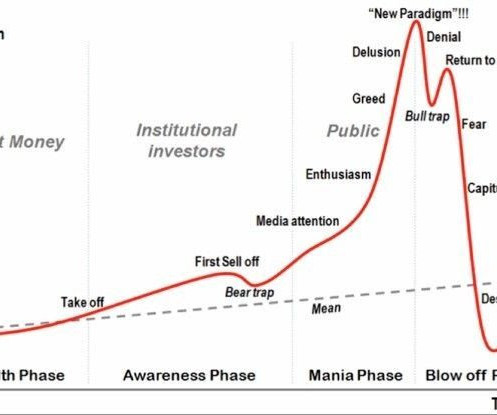

The problem is the level of valuations. Popular investment sectors or themes gain momentum as more investors join, driving prices much higher than the worth of the underlying assets. Because it has been a popular narrative for quite some time. But, what’s the problem with investing in popular narratives?

Let's personalize your content