Four Hard Investing Lessons From 2022 With Silver Linings

Validea

OCTOBER 19, 2022

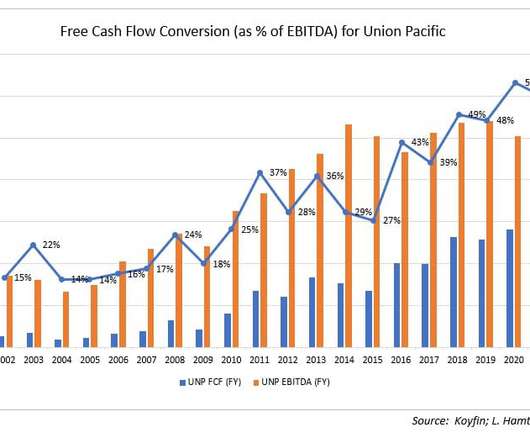

Even with bear markets like 2000-2002 and 2008-2009, the portfolio had strong returns for a very long period. While some of that outperformance was due to improving fundamentals and earnings, most of it the returns came from the valuation investors assigned to these stocks. Source: [link].

Let's personalize your content