Four Hard Investing Lessons From 2022 With Silver Linings

Validea

OCTOBER 19, 2022

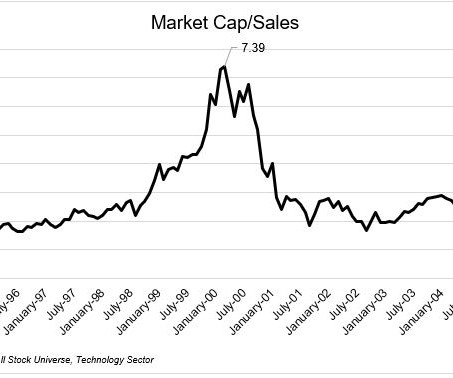

Coming into 2022, the 60/40 stock/bond portfolio had been a stalwart strategy for your balanced investor. Even with bear markets like 2000-2002 and 2008-2009, the portfolio had strong returns for a very long period. at the start of the year) things are looking brighter for this simple portfolio. Source: [link].

Let's personalize your content