Optimism vs. Pessimism: Defining Your Investing Future

Validea

NOVEMBER 29, 2023

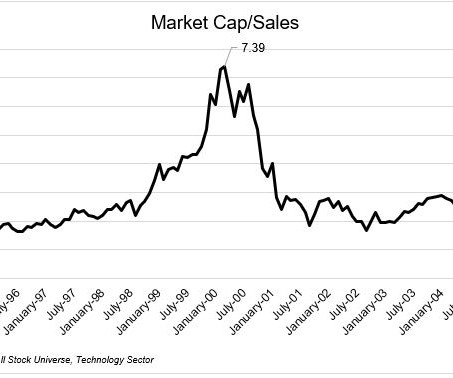

Felix outlines a number of ways to combat the cost of pessimism, including checking your investments less frequently and finding ways to automate your investing contributions, among others. Over the last 25 years, we have seen four bear markets (1999-2002, 2008-2009, 2020, 2022) and numerous market corrections (10% losses).

Let's personalize your content