Saturday links: a box of delights

Abnormal Returns

JUNE 8, 2024

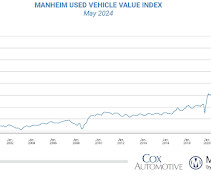

Autos Bi-directional charging would be a big boost to EV sales. (nytimes.com) Waymo is proving out the concept of autonomous cars in the Phoenix area. (wsj.com) Edmunds top EV and hybrid vehicles for 2024. (goodgoodgood.co) Transport NYC take note, most cities with congestion pricing have benefited. (reasonstobecheerful.world) The shipping industry is adding sails to their ships.

Let's personalize your content