Weekend Reading For Financial Planners (May 4-5)

Nerd's Eye View

MAY 3, 2024

Read More.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

topic

topic  Healthcare Related Topics

Healthcare Related Topics

Nationwide Financial

AUGUST 24, 2022

Related to cost , and of equal importance, is the fact that some healthcare services are not covered by Medicare. Understanding what Medicare does and does not cover allows beneficiaries to plan for healthcare costs, as well as determine how to pay for certain healthcare services that they may want or need in the future.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Carson Wealth

APRIL 4, 2024

Approaching the Conversation If you’re hesitant to broach the topic of money with your parents, you’re certainly not alone. They can even help to mediate some of the tougher topics you are hesitant to bring up with your parents. Let’s discuss a few of them.

MainStreet Financial Planning

MAY 4, 2023

Retirement housing decisions can be complex and involve many factors, such as budget, lifestyle preferences, and healthcare needs. It’s important to consider the costs associated with each option, including home maintenance, healthcare expenses, and long-term care costs. What are some common housing options for retirees?

Validea

APRIL 23, 2024

The livestream will run from 8AM to 8PM ET and will feature 24 half hour interviews with some amazing guests covering topics ranging from value investing to factor investing to macro and options. All proceeds will go to Susan G. To attend the livestream, click the link below and click notify me on the video page.

Ballast Advisors

SEPTEMBER 15, 2023

Medicare Supplements , also known as Medigap plans, are private insurance policies designed to fill in the gaps in coverage left by Medicare Part A and Part B, helping beneficiaries pay for out-of-pocket healthcare expenses such as deductibles, co-payments, and co-insurance. A broker can help. You may be able to change your plan.

eMoney Advisor

FEBRUARY 22, 2023

What to Talk About: Foundational Topics Financial Planning 101. Continuing the Conversation: Advanced Topics Philanthropy. If your client is in poor health or has had health scares in the past, caregiving and healthcare decision-making may become part of the conversation. Caregiving. Sources: 1. Cerulli Associates.

SEI

SEPTEMBER 1, 2022

Nonprofits and healthcare organizations. That's why we aim to provide you with our insights on the most relevant topics today. . Your tie to topics that support your goals, from financial health to fundraising, ERM, governance and more. Video Q&A: Trends in cryptocurrency fundraising. phernandez1. Thu, 09/01/2022 - 09:18.

eMoney Advisor

FEBRUARY 9, 2023

Now that they’re living from their retirement accounts, the financial challenges they face will include sustaining their current lifestyle, not outlasting their savings, and healthcare costs. Though it can be an uncomfortable topic to bring up, your clients will be looking to you for proactive estate guidance.

Sara Grillo

NOVEMBER 13, 2023

These folks are getting older and their healthcare is suddenly far more complex in retirement – just when they’ll be needing it. The impact of their healthcare choices on their financial plan – healthcare is a large line item. Might sound like a dumb question but let’s talk about why it’s actually a pretty big deal.

Nationwide Financial

FEBRUARY 7, 2023

Worries about Social Security funding, rising healthcare costs and higher taxes also scored among the top stressors for Black Americans when planning for retirement.

Talon Wealth

OCTOBER 26, 2023

Retirement Taxes are Difficult to Calculate Taxes are a complex topic and it can be difficult to calculate the exact amount of taxes due on your retirement income. Consider factors such as healthcare expenses, exciting travel plans, and hobbies or activities you want to pursue in retirement. This can be a mistake.

Envision Wealth Planning

SEPTEMBER 14, 2022

Smarter money moves for young single women in a new career: You can also listen and watch my presentation on this topic on the Envision Wealth Planning YouTube channel. While health insurance pays for most of your healthcare bills, it won’t replace your income that pays for your living expenses if you’re out of commission.

Talon Wealth

AUGUST 26, 2023

Retirement Taxes are Difficult to Calculate Taxes are a complex topic and it can be difficult to calculate the exact amount of taxes due on your retirement income. Consider factors such as healthcare expenses, exciting travel plans, and hobbies or activities you want to pursue in retirement. This can be a mistake.

Indigo Marketing Agency

SEPTEMBER 9, 2020

Mistake 1: Focusing On The Wrong Topics Most advisors want to talk about technical topics, such as investment strategies, Monte Carlo simulations, and sequence of returns risk. But your clients and prospects couldn’t care less about these topics. Don’t be afraid to take strong positions on the topics that matter most to you.

Nationwide Financial

AUGUST 8, 2022

While the cost of healthcare has typically increased at a rate that exceeds the inflation rate, COVID brought a temporary reprieve in the rising cost of medical care expenses. They generally assume Medicare will cover most, if not all, of their healthcare expenses. vs. 4.4%). Helping clients prepare for retiree medical costs.

Harness Wealth

JUNE 23, 2023

Key Components of an Estate Plan A comprehensive estate plan consists of several key components, including wills and trusts, power of attorney, healthcare directives, and beneficiary designations. Moreover, inadequate planning can cause legal disputes among your heirs, and potentially subject your estate to unnecessary taxes and probate fees.

Walkner Condon Financial Advisors

JUNE 27, 2023

Note that not every topic below will be relevant to your situation, nor is this an exhaustive list. You should assess your healthcare situation, insurance needs, and the financial impact of utilizing such an account. hence why those topics are addressed earlier in the blog!). I’ve written several blogs on this topic.

Walkner Condon Financial Advisors

JUNE 27, 2023

Note that not every topic below will be relevant to your situation, nor is this an exhaustive list. You should assess your healthcare situation, insurance needs, and the financial impact of utilizing such an account. hence why those topics are addressed earlier in the blog!). I’ve written several blogs on this topic.

Cornerstone Financial Advisory

DECEMBER 26, 2023

While this information should not substitute for medical advice from your healthcare provider, implementing better habits, like frequent handwashing, wearing a face mask, and avoiding anyone ill, may help you and your loved ones stay healthy this flu season.

Cornerstone Financial Advisory

MARCH 18, 2024

But before getting started with any fitness regimen, discuss any medical concerns with your healthcare provider; this information is not a substitute for medical advice. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest.

Brown Advisory

AUGUST 11, 2023

FTV 20% “Healthcare – industry recovery is on track as labor and productivity challenges moderate.” RTX -5% “Global commercial air traffic remains on track…very robust summer travel season.” Thanks for reading, and remember to never skip a Beat - Eric More on this topic CIO Perspectives Podcast: A New Bull Market?

Cornerstone Financial Advisory

OCTOBER 23, 2023

TXN), HCA Healthcare, Inc. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. This Week: Companies Reporting Earnings Tuesday: Microsoft Corporation (MSFT), General Electric Company (GE), Verizon Communications, Inc. (VZ), VZ), Alphabet, Inc. HCA), NextEra Energy, Inc.

SEI

AUGUST 2, 2022

Nonprofits and healthcare organizations. Discussions covered a range of topics, including foundation operations, inflation and return expectations, processes for unspent distributions, asset allocation changes, and governance findings. Governance. Higher education. Institutional (US). About the event.

Trade Brains

NOVEMBER 22, 2023

As these machines continue to reshape the way we work and live, investing in drone stocks has become a topic of interest for many. AI is used in many sectors from self-driving cars, smart assistants, and manufacturing robots to healthcare management and automated financial investing.

Cornerstone Financial Advisory

APRIL 17, 2023

Friday: The Procter & Gamble Company (PG), HCA Healthcare, Inc. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. (BX), American Express Company (AXP), CSX Corporation (CSX), Union Pacific Corporation (UNP), D.R. Horton (DHI), Truist Financial Corporation (TFC).

Cornerstone Financial Advisory

JUNE 19, 2023

But before getting started with any fitness regimen, discuss any medical concerns with your healthcare provider; this information is not a substitute for medical advice. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest.

Harness Wealth

JUNE 9, 2023

To make things even easier, we recommend splitting your goals and needs into three distinct categories: Needs: These are your necessities: housing, food, emergency fund, healthcare, etc. You should also evaluate any existing or potential healthcare needs and how best to incorporate those into your financial plan.

Cornerstone Financial Advisory

JULY 24, 2023

MA), Bristol Myers Squibb Company (BMY), McDonald’s Corporation (MCD), Northrop Grumman Corporation (NOC), HCA Healthcare, Inc. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. (AMZN), Intel Corporation (INTC), Ford Motor Company (F), AbbVie, Inc. ABBV), Mastercard, Inc.

Cornerstone Financial Advisory

SEPTEMBER 6, 2022

Sectors seeing the most significant increases in new jobs were professional and business services, healthcare, and retail. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. Wages continued to grow, rising 0.3% in August and 5.2% from 12 months ago.

Clever Girl Finance

SEPTEMBER 7, 2023

List your essential needs—housing, groceries, utilities, and healthcare. It creates an environment where money becomes an openly discussed topic—no more hushed conversations or avoidance. Healthcare Medical expenses are a critical consideration for every family budget. Then, consider your wants.

Cornerstone Financial Advisory

DECEMBER 19, 2022

The IRS recommends keeping records of property records, healthcare insurance, and business income and expenses, among other categories. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. We suggest that you discuss your specific tax issues with a qualified tax professional.

Cornerstone Financial Advisory

MAY 22, 2023

But first, discuss any medical concerns with your healthcare provider before beginning any diet or fitness regimen. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. Please consult legal or tax professionals for specific information regarding your individual situation.

The Richer Geek

JANUARY 26, 2022

It's something that our generation or just people in general, are in need of, especially as investing becomes more of a topic that's discussed in court are common conversations” “The annual reports have the company's financial statement. And they cover an array of financial concepts.

Cornerstone Financial Advisory

MAY 1, 2023

While this information should not substitute for medical advice from your healthcare provider, implementing better habits, like frequent handwashing, wearing a face mask, and avoiding anyone ill, may help you and your loved ones stay healthy this flu season.

Clever Girl Finance

AUGUST 8, 2022

Like so many financial topics, the answer is maybe. While many European countries have a similar or even higher cost of living than the US, most provide excellent and affordable healthcare coverage — a major benefit for older ex-pats. Can you retire with 500k, or do you need more? Is it realistic to retire with 500k? The good news?

Cornerstone Financial Advisory

JULY 17, 2023

Despite some positive earnings surprises from several big banks and a major healthcare provider, stocks closed out a good week with a slight decline. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest.

Cornerstone Financial Advisory

JULY 11, 2022

In an effort to extend health care benefits to more people, the IRS introduced the small business healthcare tax credit. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. . “Alone we can do so little; together we can do so much.” Helen Keller.

Trade Brains

DECEMBER 11, 2022

Torrent Pharma is counted as a leader in multiple therapeutic segments: cardiovascular (CV), central nervous system (CNS), gastrointestinal (GI), and women’s healthcare (WHC). These sites produce a broad range of products including oral solids, topicals, human insulin, and synthetic API.

Cornerstone Financial Advisory

JANUARY 23, 2023

Friday: Chevron Corporation(CVX), HCA Healthcare, Inc. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. (V), Mastercard, Inc. (MA), MA), Blackstone, Inc. (BX), BX), Northrop Grumman Corporation (NOC), Southwest Airlines Co. LUV), Rockwell Automation, Inc.

Cornerstone Financial Advisory

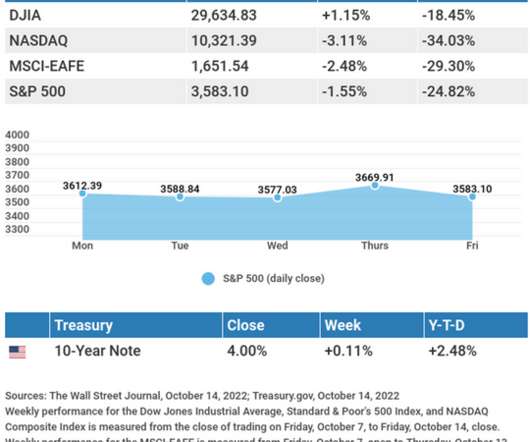

OCTOBER 17, 2022

VZ), HCA Healthcare, Inc. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. (UAL), International Business Machines Corporation (IBM), The Procter & Gamble Company (PG), Lam Research Corporation (LRCX), Abbott Laboratories (ABT). Thursday: AT&T, Inc. (T),

Clever Girl Finance

OCTOBER 14, 2022

In addition to the basics like healthcare and car insurance, consider renters insurance, homeowners insurance, life insurance, and disability insurance. As you learn to manage your money, explore the topic further by learning about your relationship with money and how to plan your finances.

Brown Advisory

OCTOBER 28, 2021

MORE ON THIS TOPIC Podcast: Navigating Our World (NOW) S1|Episode 7 - Freedom to Read: A conversation with Dr. Carla Hayden, Librarian of Congress For Dr. Carla Hayden, libraries are freedom in action: Whether physical or online, libraries provide all people access to information, opportunity and education.

Brown Advisory

OCTOBER 28, 2021

MORE ON THIS TOPIC. Caryl’s energy, determination and no-nonsense approach are empowering, and we are thrilled to have the opportunity to learn from her during this precarious time—as the pandemic, economic crisis and movement for racial justice illuminate the deep-seated inequities in our communities. . Podcast: Navigating Our World (NOW).

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content