Retirement Tech Startup Notches $1.33B Valuation

Wealth Management

JULY 17, 2024

Human Interest helps small businesses set up 401(k) services.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JULY 17, 2024

Human Interest helps small businesses set up 401(k) services.

Abnormal Returns

DECEMBER 3, 2024

techcrunch.com) Musk SpaceX could soon be the world's most valuable startup with a $350 billion valuation. theverge.com) Fidelity marked up its valuation of X. (wsj.com) Meta ($META) is reportedly investing $10 billion in subsea cables. finance.yahoo.com) Elon Musk's Tesla ($TSLA) pay package was rejected, again.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Big Picture

APRIL 17, 2025

An instructive war story : During the mid-1990s, a grad school buddy took a senior job at a tech startup that came with lots of stock. My advice was not based on fear of a bubble or the (over)valuation of Yahoo; rather, I suggested employing a regret minimization framework.2 In late 1996, they were bought by Yahoo!

Abnormal Returns

MARCH 12, 2024

morningstar.com) Has Nvidia ($NVDA) earned it valuation? newsletter.abnormalreturns.com) Mixed media How some media startups are thriving by focusing on subscriptions and newsletters. Markets Are the Magnificent Seven all that overvalued? theirrelevantinvestor.com) Crypto Why this crypto rally is different. frontofficesports.com)

Abnormal Returns

JUNE 27, 2024

hbr.org) Startups SpaceX is doing a tender at a $210 billion valuation. (safalniveshak.com) Companies Monster Beverage ($MNST) is unique not only for its stock performance. kyla.substack.com) How Starbucks ($SBUX) devalued its brand. bloomberg.com) A24 just raised a new round of capital.

Abnormal Returns

JANUARY 20, 2023

ft.com) Startups How unicorns are dealing with the decline in valuations. news.crunchbase.com) Crypto companies, like FTX, invested in a bunch of crypto startups. (on.ft.com) The CPA shortage is real. wsj.com) Why PE firms are reluctant to put 'dry powder' to work. Those stakes are set to change hands.

Abnormal Returns

FEBRUARY 28, 2024

on.ft.com) Private credit valuations are all over the board. bloomberg.com) Startups Stripe employees just sold shares at a $65 billion valuation. (disciplinefunds.com) What happens if you invest at a stock market top? awealthofcommonsense.com) Private credit Private credit fundraising is slowing.

Abnormal Returns

JANUARY 3, 2023

feld.com) 2023 is going to be a year or reckoning for the startup space. wsj.com) Startups are going to experience a "new normal" valuation-wise. avc.com) SpaceX is raising new capital at a $137 billion valuation. (nytimes.com) Venture capital Brad Feld, "Nothing is going to magically and suddenly change for the better."

Abnormal Returns

DECEMBER 5, 2022

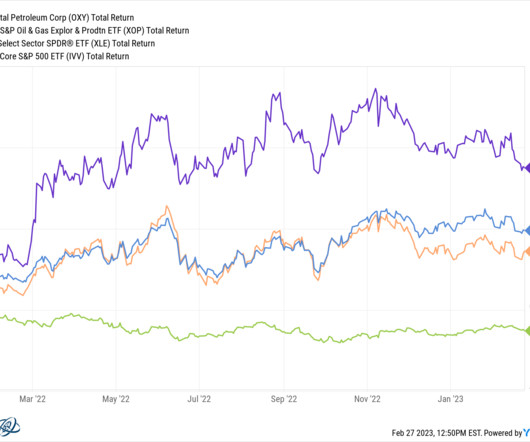

Markets Small cap stocks stand out for their cheap valuations. bam.kalzumeus.com) Venture capital The hurdles that startups need to get over to raise additional capital are now higher. niemanlab.org) How newsletter startup Puck sets itself apart. morningstar.com) Why have energy stocks and oil prices diverged? wired.com).

Abnormal Returns

JULY 25, 2023

institutionalinvestor.com) Mutual funds Do mutual funds overvalue their stakes in startups? papers.ssrn.com) Research It makes total sense that equity market valuations are higher today than in the past. (mailchi.mp) PE firms have been slow to adopt ESG principles. papers.ssrn.com) How disappointment drives a lot of fund outflows.

Abnormal Returns

DECEMBER 7, 2023

nytimes.com) Is Austin, TX losing its luster as a startup hub? techcrunch.com) SpaceX SpaceX is reportedly planning a tender offer for employee shares at a $175 billion valuation. (ft.com) VC SimpleClosure, a start-up that helps other start-ups wind down their operations, is doing a booming business.

Abnormal Returns

JUNE 15, 2023

theinformation.com) Is there an AI premium for startup valuations? (msn.com) AI The story of how Microsoft ($MSFT) became the leader in AI. bloomberg.com) How YouTube could help Google ($GOOGL) with its AI push. tomtunguz.com) AI-generated junk is flooding Etsy ($ETSY).

Abnormal Returns

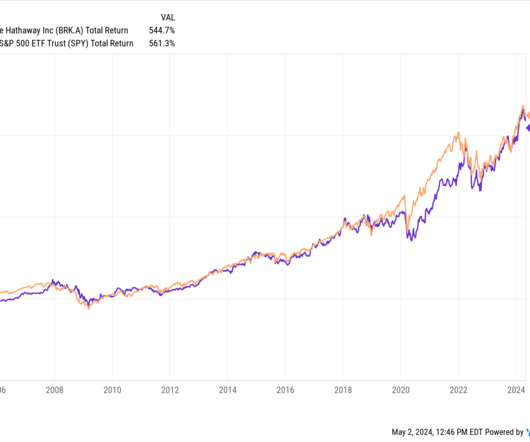

MAY 2, 2024

Does that mean you are less enamored of Berkshire shares at current valuations? ' (barrons.com) How long will Ajit Jain stay in the lead of Berkshire's insurance business? newyorker.com) What to do about startups that borrowed money in age of ZIRP. ft.com) Why it's difficult for Berkshire Hathaway ($BRK.A)

The Big Picture

JANUARY 12, 2024

Valuations, workouts, opportunistic investing, and managing underwater properties were part of the many prospects the GFC created that allowed thoughtful observers to add to their skill set and learn from experiences. She became Senior Portfolio Manager for PGIM Real Estate’s flagship core equity real estate fund.

Abnormal Returns

JULY 28, 2023

tomtunguz.com) With valuations down, why aren't big tech companies buying more startups? (awealthofcommonsense.com) Big Tech All things considered, Meta ($META) and Google ($GOOGL) dominate online ad spending. marketwatch.com) How Amazon ($AMZN) is targeting AI. bigtechnology.com) How AI is affecting infrastructure spending.

Abnormal Returns

JUNE 27, 2023

bloomberg.com) SpaceX's valuation keeps rising, due in part to Starlink's success. wsj.com) Investors are heading to secondary exchanges to buy shares in AI startups. (monevator.com) Companies IBM ($IBM) keeps acquiring smaller companies to seemingly very little effect.

Abnormal Returns

MARCH 20, 2024

marginalrevolution.com) Finance Private equity is stuck between elevated valuations high interest rates and a moribund IPO market. variety.com) Streaming is so complicated that it needs a startup to help consumers navigate it. (amycastor.com) Companies It's hard to wrap your head around the numbers with Nvidia's ($NVDA) new chips.

The Big Picture

MAY 5, 2023

Finally, it would be dangerous to extrapolate the post-1990 outperformance of US equities, as it mainly reflects rising relative valuations. NPR ) • How Silicon Valley’s Troubles Are Reshaping Venture Capital : After unprecedented dominance of US startup funding in the 2010s, the region has lost some ground. But it’s still No.

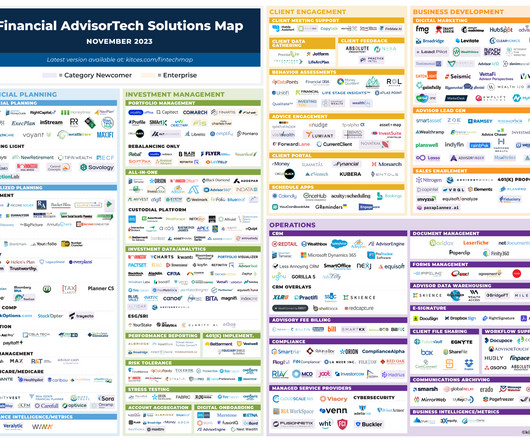

Nerd's Eye View

NOVEMBER 6, 2023

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including: FinanceHQ has launched as a new digital lead generation platform for financial advisors, which takes a more niche-focused approach to matching prospective clients with advisors – representing a bet that capturing prospects (..)

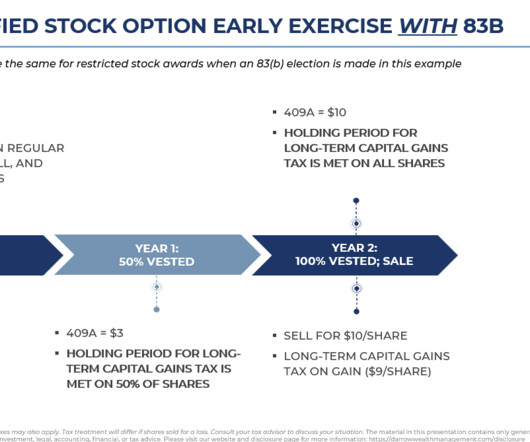

Darrow Wealth Management

FEBRUARY 20, 2023

Working for a startup can pay off big financially, but a lot must go right along the way. If you are considering taking a job at a startup or private company with plans for an exit, there’s a lot to consider before accepting an offer. Here are some considerations for how to negotiate equity in a private company or startup.

The Big Picture

OCTOBER 2, 2024

She has been an early investor in companies that went public such as FIGS, Casper, and CloudFlare, as well as startups like Gimlett and Lightwell, that were later acquired by Spotify and Twitter. billion dollar startups have a founder who came here as a student. Typically the, the valuations are. Just hyperbolic in the U.

Abnormal Returns

FEBRUARY 27, 2023

capitalgains.thediff.co) Startups How increased regulatory risk is affecting startup valuations. theinformation.com) What makes for a great startup name. (axios.com) Job number one for CEOs is capital allocation. tomtunguz.com) Why Stripe trades at a discount to public traded Adyen.

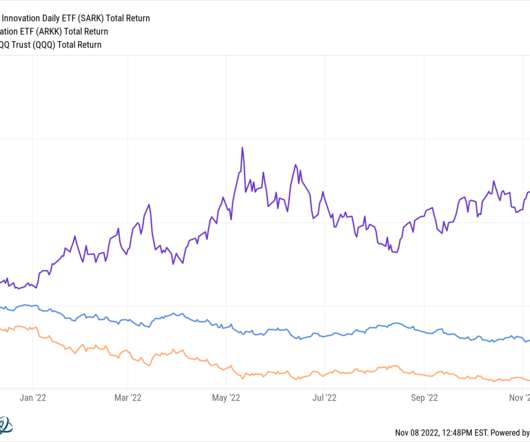

Abnormal Returns

NOVEMBER 8, 2022

rationalwalk.com) Venture capital Tomasz Tunguz, "8% annual inflation for a startup means losing a month of runway every year." tomtunguz.com) Why early-stage startup valuations are holding up better than later stages. (nytimes.com) A closer look at Berkshire Hathaway's ($BRK.A) operating earnings.

Darrow Wealth Management

APRIL 23, 2025

The 83(b) election has the potential to significantly reduce the overall tax liability, especially for startup founders and employees who receive stock-based compensation. Stock at early-stage startups usually will have a very, very low valuation, making this tax strategy most advantageous. Here are some things to consider.

Abnormal Returns

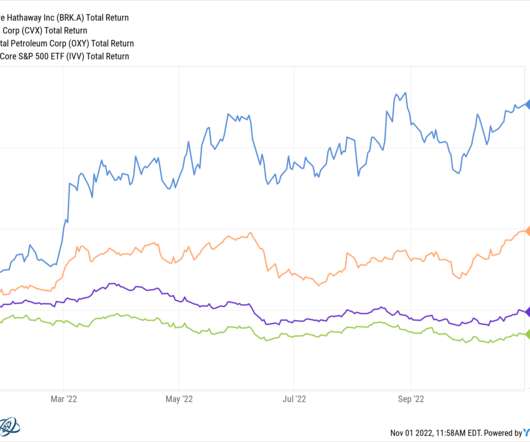

NOVEMBER 1, 2022

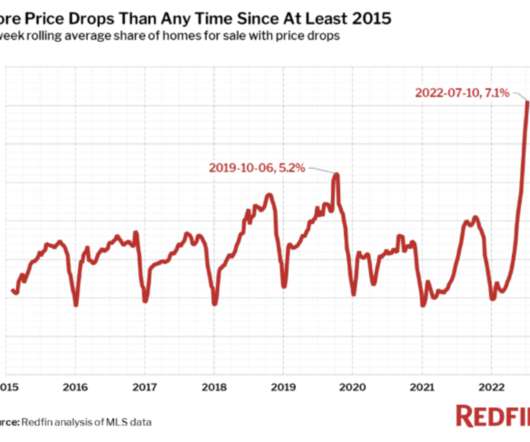

every.to) Q3 saw big drops in startup valuations. cbinsights.com) The top 100 universities ranked by startup founders. (wsj.com) Women are still scarce in the top levels of private equity. axios.com) Venture capital Why venture capital is ripe for disruption.

The Big Picture

AUGUST 21, 2024

Full transcript below. ~~~ About this week’s guest: Professor Aswath Damodaran of NYU Stern School of Business is known as the Dean of Valuation. He has written numerous books on valuation and finance. A very young, a startup is like a baby, needs constant care and attention and capital. Forget about year five, year ten.

Abnormal Returns

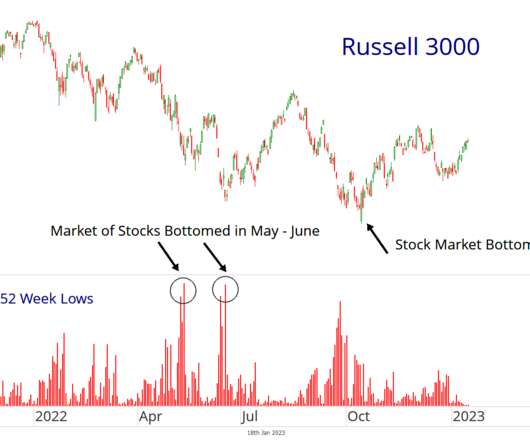

JANUARY 18, 2023

institutionalinvestor.com) Startup valuations trended down in the second half of 2022. (washingtonpost.com) Finance Morgan Stanley ($MS) is besting Goldman Sachs ($GS) when it comes to wealth management. wsj.com) PE firms are still having problems keeping junior analysts. institutionalinvestor.com) Economy Retail sales fell 1.1%

Abnormal Returns

AUGUST 22, 2022

investmentnews.com) What's the story behind the valuation behind startup Farther? (investmentnews.com) How Creative Planning came to be comfortable doing acquisitions. riabiz.com) How M&A transactions are getting structured in light of a bear market. morningstar.com) Why don't more people carry umbrella insurance?

Darrow Wealth Management

JULY 30, 2024

Startup founders, early employees, executives, and other service providers can make an 83(b) election. Stock at early-stage startups usually will have a very, very low valuation, making this tax strategy possible. For employees with stock options, making an 83(b) election can be important later if valuations increase.

The Big Picture

OCTOBER 2, 2024

She has been an early investor in companies that went public such as FIGS, Casper, and CloudFlare, as well as startups like Gimlett and Lightwell, that were later acquired by Spotify and Twitter. billion dollar startups have a founder who came here as a student. Typically the, the valuations are. Just hyperbolic in the U.

Harness Wealth

FEBRUARY 26, 2023

Many of the insights below are ones that are understood well by second or third-time founders or startup veterans, who learned about these specific tax provisions from experience and are ready to implement them when they start their subsequent ventures. In this type of stock option, no stock pricing is required.

Abnormal Returns

JUNE 11, 2023

platformer.news) VC You can expect to see more startups closing up shop as funding dries. wsj.com) How a seed investor approaches valuation discussions. (axios.com) How the Apple Watch saved the luxury watch industry. om.co) Twitter really hates paying its bills. hunterwalk.com) Focus matters for VCs.

Advisor Perspectives

APRIL 3, 2025

has raised $308 million in a new round of funding that more than doubles the company’s valuation — a sign of investor enthusiasm for startups building artificial intelligence software that can generate videos. Runway AI Inc.

Harness Wealth

APRIL 17, 2023

Equity compensation is a popular strategy used by startups to attract and retain top talent, and it can sometimes result in significant financial rewards for founders and employees alike. Pros and Cons of Tender Offers for Startup Employees Personal Financial Planning Considerations Frequently Asked Questions What is a Tender Offer?

Harness Wealth

APRIL 16, 2025

Key takeaways Tax planning impacts every facet of an acquisition, from initial valuation to post-closing integration, with early strategic decisions potentially saving millions in future tax liabilities. Understanding tax implications of acquisitions is vital for startups exploring mergers and acquisitions.

Harness Wealth

FEBRUARY 27, 2023

Founders, board members, and employees of startups that get acquired can experience tax consequences as a result of a liquidity event. It’s imperative to plan for the tax implications so you can be prepared to pay what you owe the IRS.

oXYGen Financial

NOVEMBER 24, 2023

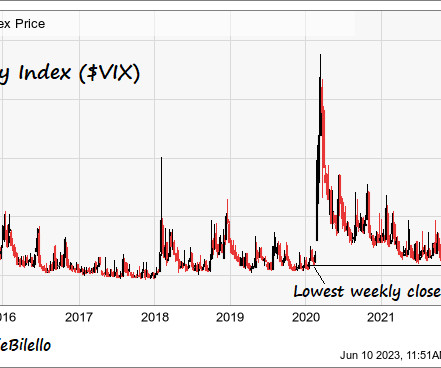

The Irrelevant Investor

JULY 16, 2022

Articles What hard startups today will produce the enormous companies and categories of the future? (By

Harness Wealth

OCTOBER 5, 2024

What to Consider Before Selling in a Secondary Sale How to Sell Private Company Stock The Pros and Cons of a Secondary Sale If you work for a private company, especially a startup or tech firm, you may own stock or stock options as part of your compensation. Popular marketplaces include: Forge SharesPost EquityZen Hiive 2.

Advisor Perspectives

JANUARY 27, 2025

Chinese artificial intelligence startup DeepSeek’s latest AI model sparked a $1 trillion rout in US and European technology stocks, as investors questioned bloated valuations for some of America’s biggest companies.

The Irrelevant Investor

OCTOBER 30, 2021

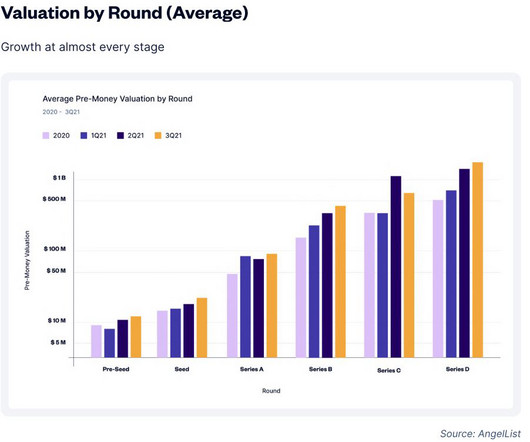

In a new report from AngelList, they shared that: In 4Q20, 80% of startups that changed valuations were marked up or had a positive exit—a new record for startups on AngelList at the time. Series B valuations are up 31% to $375 million. Private markets are enjoying the same up only type of activity.

WiserAdvisor

MAY 29, 2025

Growth investors look for companies that are expected to grow revenues and profits at an above-average rate such as tech firms, innovation-driven startups, and companies expanding into new markets. The key is to evaluate whether the companys future prospects justify its current valuation.

Brown Advisory

MARCH 9, 2023

Jon shares his boots-on-the-ground view of how the venture landscape is shaping up, including the hype around AI startups.

Darrow Wealth Management

JUNE 2, 2022

Quite simply, a down round is when a company raises money at a lower valuation per share relative to earlier financing rounds. A simple example: a startup raises a Series B at a $30M post-money valuation and a Series C at a $20M post-money valuation. Working for a startup involves risk. Startups also need cash.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content