Top 5 Risk Management Strategies

Risk Management Guru

OCTOBER 3, 2022

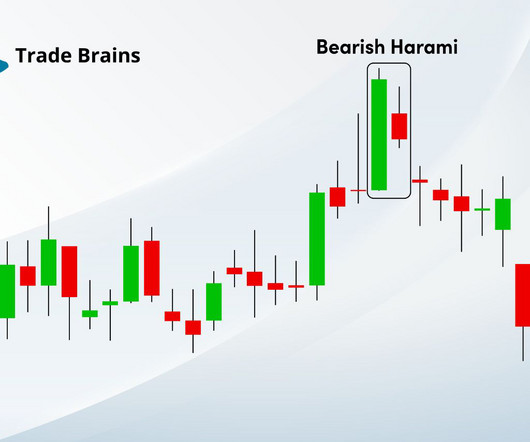

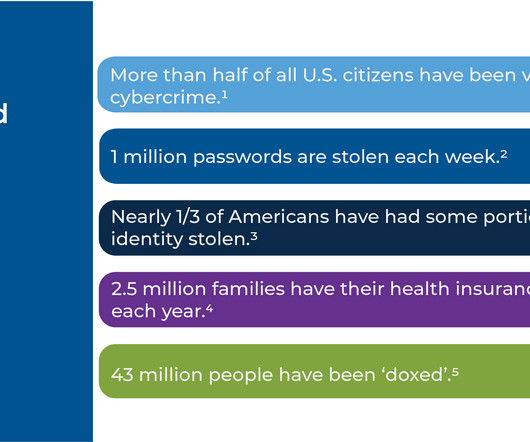

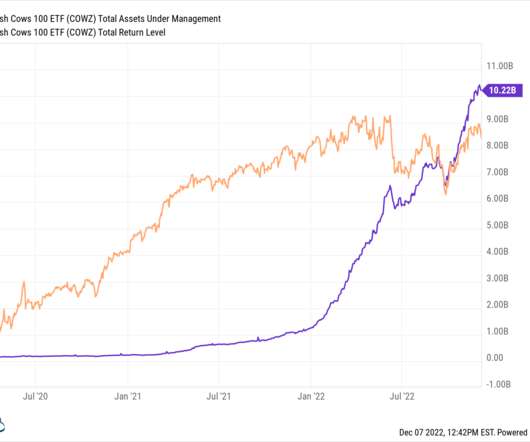

There are basically five strategies which can help you in allocating your risk management. If you have a firm grasp of these elements and how they influence stock market fluctuations, you will be in a better position to plan your investments. Stock Market Risk Management Strategies. Learn about the company.

Let's personalize your content