Research links: strict risk management

Abnormal Returns

JULY 26, 2022

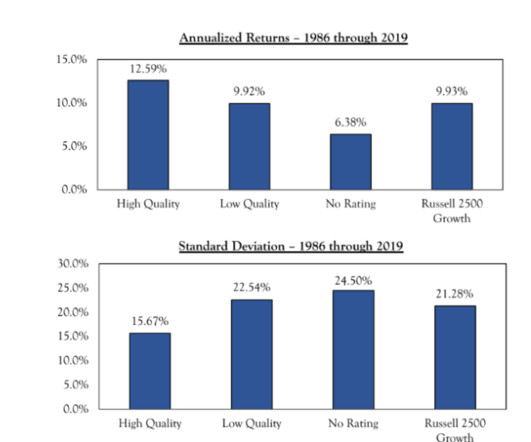

morningstar.com) How have multi-factor portfolios performed in practice. klementoninvesting.substack.com) The research shows that short sellers are informed investors. (insights.factorresearch.com) Can Twitter be used to forecast inflation? papers.ssrn.com) It's hard to find much evidence in favor of individual investor outperformance.

Let's personalize your content