3rd Quarter Economic And Market Outlook: Understanding Risks And Opportunities In The Web Of Inflation, Interest Rates, Valuations, And More

Nerd's Eye View

OCTOBER 4, 2023

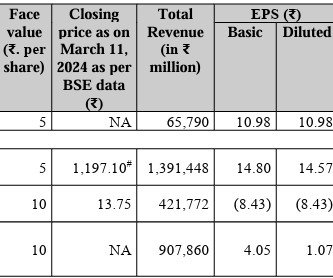

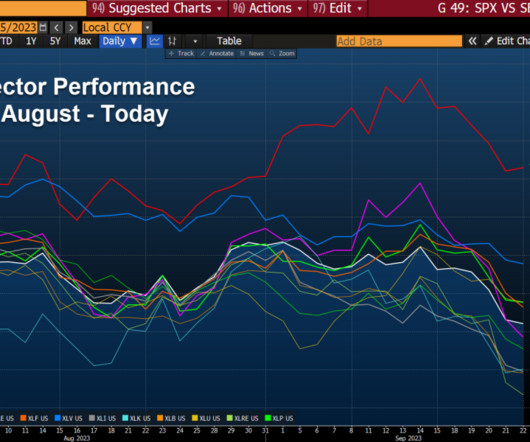

The expectations for the future economic outlook also appear in the valuations of equities, which tend to reflect how markets anticipate that corporate earnings will grow in the future. And even though U.S.

Let's personalize your content