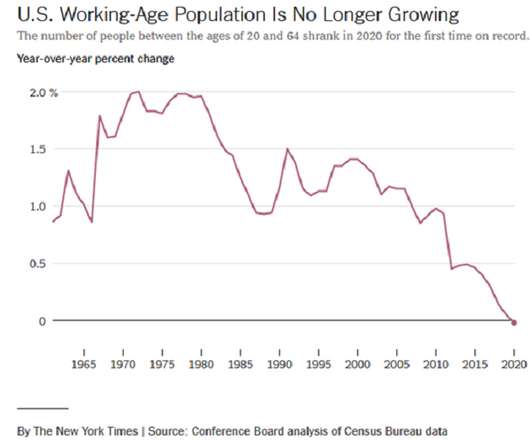

You Need To Work Longer But Will Be Forced To Retire Earlier

Random Roger's Retirement Planning

APRIL 28, 2024

Writing for Bloomberg, Allison Schrager suggests that in order to enjoy retirement, we should work a little longer. Ann Tergesen at the Wall Street Journal reports that while most people expect to retire at 65, 62 ends up being more like it. I haven't even mentioned coming up short in retirement savings. Summing up Schrager.

Let's personalize your content