Five Things to do During a Stock Market Correction

The Chicago Financial Planner

JUNE 13, 2022

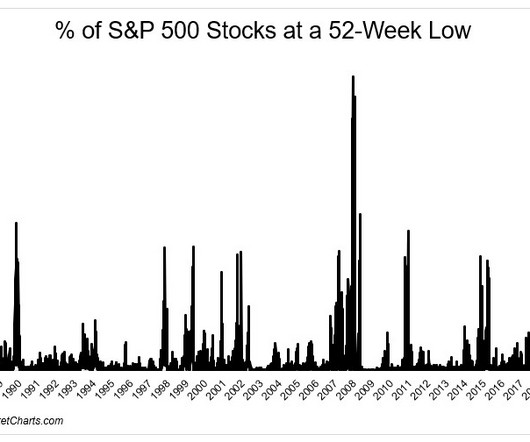

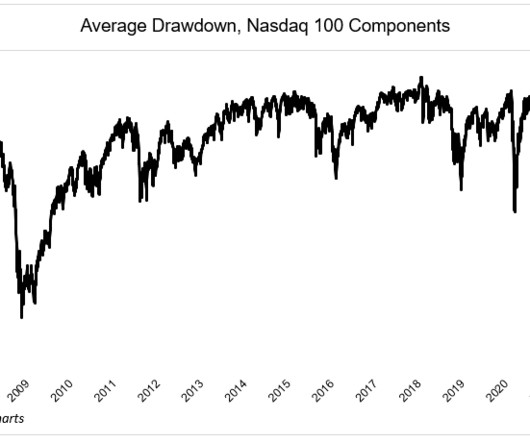

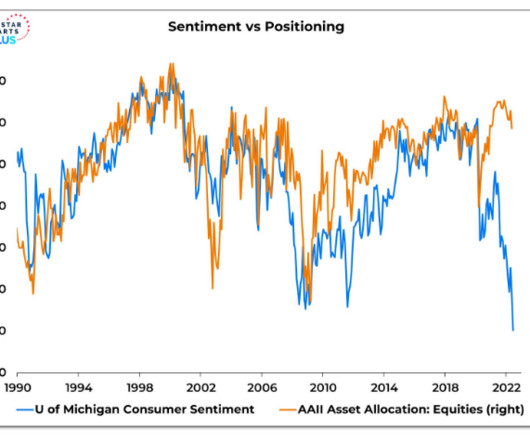

After a strong finish in 2020 and very solid returns in 2021, we’ve seen a lot of market volatility so far in 2022. The S&P 500 index was down about 17.6% on a year-to-date basis as of Friday’s close. The combination of higher inflation, higher interest rates and the situation in Ukraine are all fueling this market volatility. Nobody can predict how long this will last.

Let's personalize your content