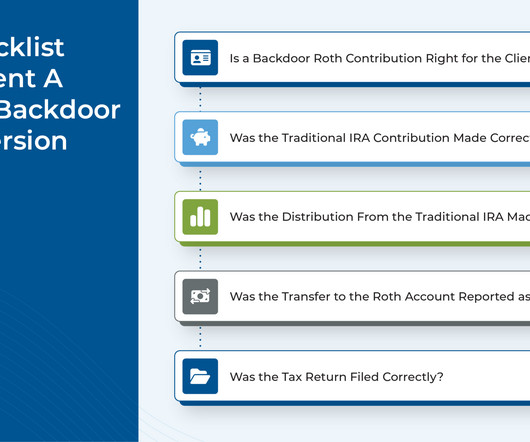

Effective Implementation Of A Backdoor Roth Strategy: Detailed Nuances, IRS Form 8606 (And When It’s Even Worth Doing)

Nerd's Eye View

NOVEMBER 1, 2023

There are many tax planning strategies that allow financial advisors to demonstrate the ongoing value they provide to clients in exchange for the fees they charge. Part of this value is understanding the detailed nuances that make a strategy effective and implementing it correctly, avoiding issues with the IRS down the line. For instance, while backdoor Roth conversions are a well-known strategy, many individuals have either missed the opportunity to use it and/or implemented it incorrectly R

Let's personalize your content