StrongBox Wealth: Picking Deep Moat, Rising Dividend Stocks

Wealth Management

JANUARY 25, 2024

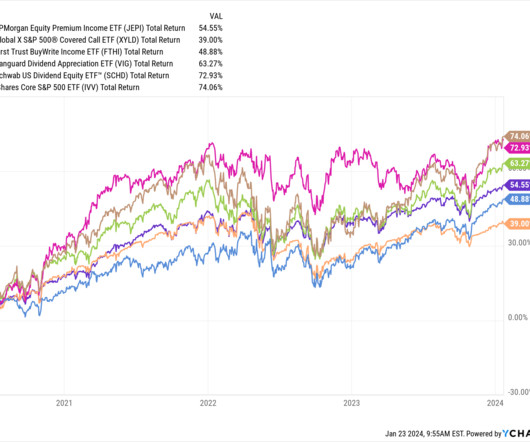

Chuck Cooper III, advisor and managing partner at Lee’s Summit, Mo.-based StrongBox Wealth, provides a peek inside the $400 million RIA’s stock picking strategy within its high conviction, conservative growth model portfolio.

Let's personalize your content