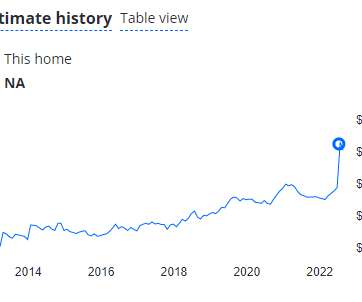

U.S. Cropland Values Hit Record Highs

The Big Picture

AUGUST 30, 2022

Source: AgWeb. If you are interested (as I am) in Real Estate , then allow me to suggest you consider exploring the world of Farmland. It is something I have done for a while, and it is a fascinating rabbit hole to fall into. Not so much as an investor, but as someone interested in how agriculture works (but yes, there is an investor angle here as well).

Let's personalize your content