Tuesday links: a love/hate relationship

Abnormal Returns

FEBRUARY 27, 2024

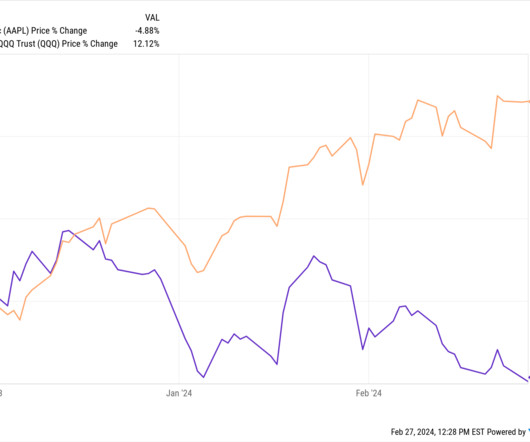

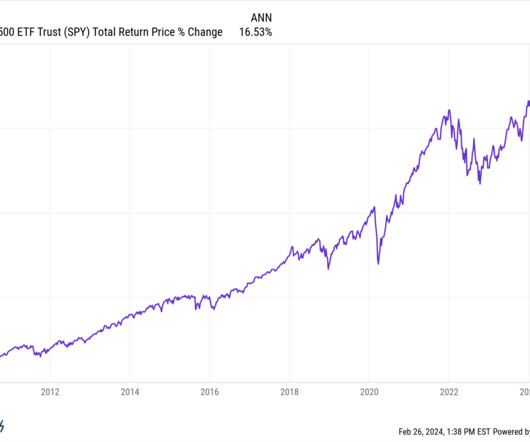

Markets Communications and health care are leading the U.S. market in 2024. (capitalspectator.com) A closer look at Europe's answer to the Magnificent Seven stocks, GRANOLA. (biopharmadive.com) Strategy What happens when you invest right before a bear market? (awealthofcommonsense.com) The case for, but mostly against, dividend-focused ETFs. (ofdollarsanddata.com) Why it's so easy to get sucked into trading too much.

Let's personalize your content