Thursday links: starting with the end in mind

Abnormal Returns

MAY 11, 2023

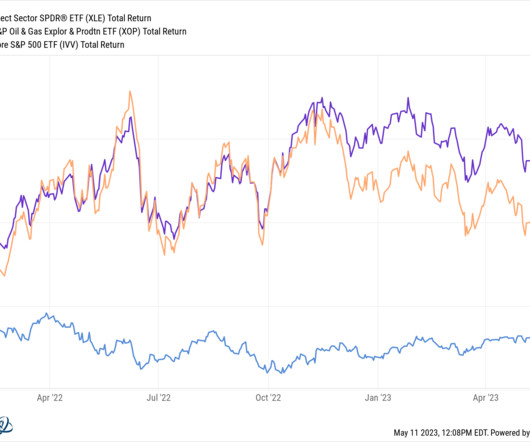

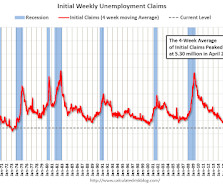

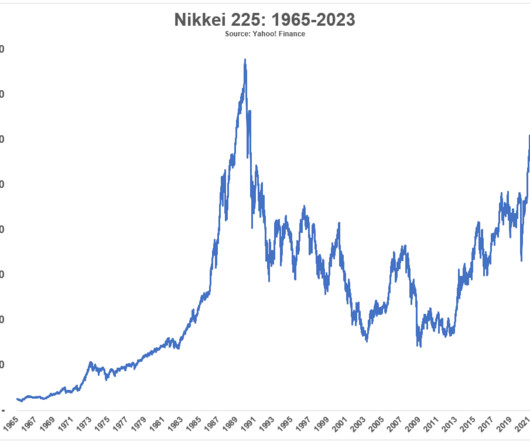

Markets What's the best asset to hold during a recession? (morningstar.com) If you invest in stocks there are going to be extended periods of poor performance. (bestinterest.blog) Companies Disney+ ($DIS) shed 4 million subscribers in Q1. (variety.com) How fast is Starbucks ($SBUX) growing outside the U.S.? (investmenttalk.co) What Google ($GOOGL) has going on in AI.

Let's personalize your content