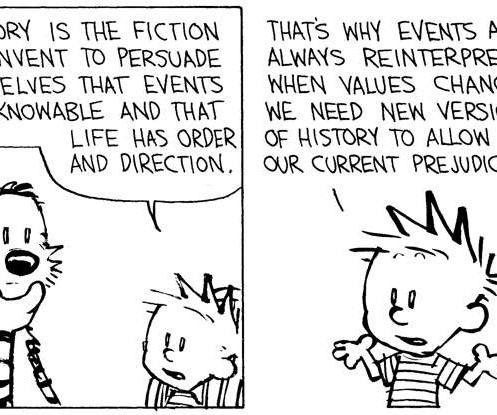

Nobody Knows Anything, Calvin & Hobbes edition

The Big Picture

AUGUST 14, 2023

Previously : Nobody Knows Nuthin’ (May 5, 2016) Can Anyone Catch Nokia? (October 26, 2022) Why the Apple Store Will Fail (May 20, 2021) “No matter how you cut it, you’ve got to own Cisco” -2000 (May 15, 2023) Nobody Knows Anything, 2023 First Half Edition (June 30, 2023) Nobody Knows Anything (Collection) The post Nobody Knows Anything, Calvin & Hobbes edition appeared first on The Big Picture.

Let's personalize your content