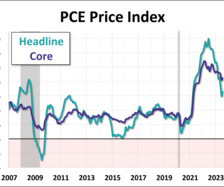

Personal Consumption Expenditures Price Index: +0.2%

The Big Picture

AUGUST 31, 2023

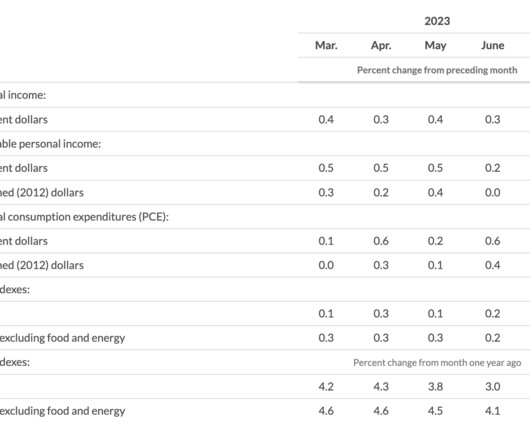

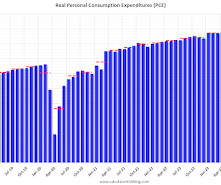

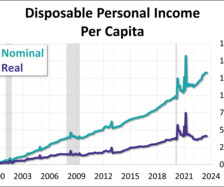

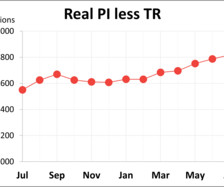

The Fed’s favored inflation report was a 2.1% annualized (3 months through July) and 3.3% year-over-year. Here is BEA: Personal income increased $45.0 billion (0.2 percent at a monthly rate) in July, according to estimates released today by the Bureau of Economic Analysis (table 3 and table 5). Disposable personal income (DPI), personal income less personal current taxes, increased $7.3 billion (less than 0.1 percent) and personal consumption expenditures (PCE) increased $144.6 billio

Let's personalize your content