The Price of Food Jumps Again in November, What's in Your Basket?

Mish Talk

DECEMBER 14, 2022

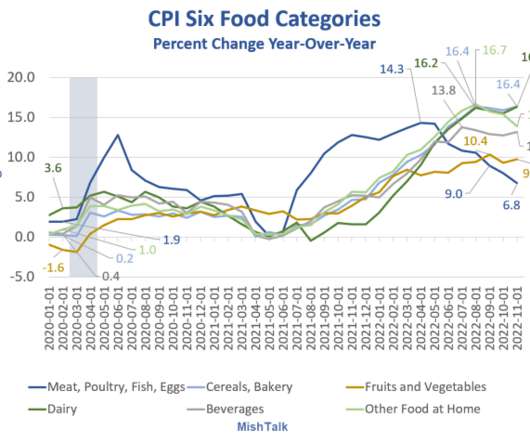

Month-over-month CPI food prices from the BLS, chart by Mish. Month-Over-Month Details For November Meat, Fish, Poultry, Eggs: -0.2%, up 9 of 11 months in 2022 Cereals and Bakery:+1.1%, up 11 of 11 months in 2022 Dairy: +0.7 percent: up 11 of 11 months in 2022 Fruits and Vegetables: up 1.4%, up 9 of 11 months in 2022 Nonalcoholic Beverages: -0.3%, up 10 of 11 months in 2022 Other Food at Home: -0.1%, up 10 of 11 months in 2022 Three Major Food Categories.

Let's personalize your content