Sunday links: frictions and costs

Abnormal Returns

JULY 23, 2023

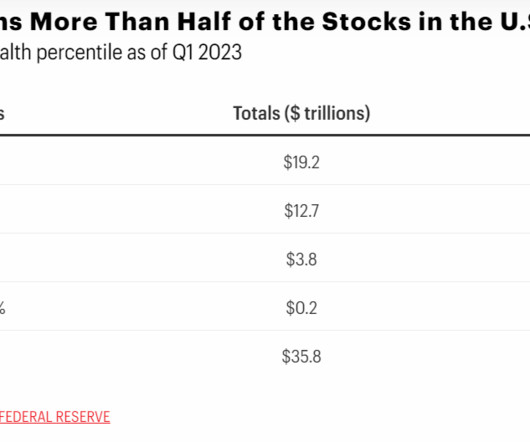

Markets Sam Ro, "I think we sometimes take for granted how much the frictions and costs have come down for those seeking to trade or invest in stocks." (tker.co) Has sentiment already peaked? (allstarcharts.com) Strategy Cullen Roche, "Insurance is designed to provide you with short-term certainty around an uncertain outlier event. And when cash is yielding a high real return I think you can argue that cash is the ultimate portfolio insurance.

Let's personalize your content