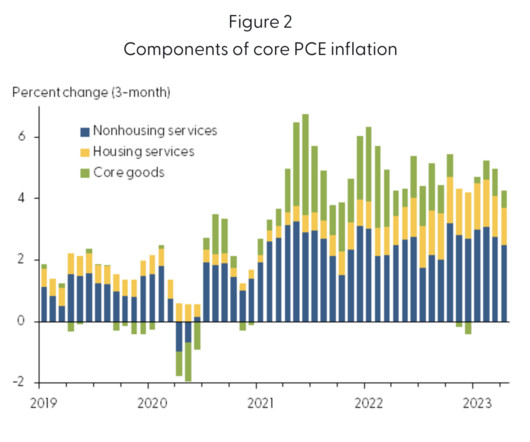

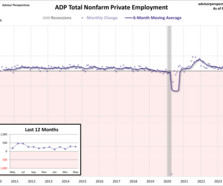

Are Labor Costs Driving Inflation? (No)

The Big Picture

JUNE 1, 2023

“Tight labor markets have raised concerns about the role of labor costs in persistently high inflation readings. Analysis shows that higher labor costs are passed along to customers in the form of higher nonhousing services prices, however the effect on overall inflation is very small. Labor-cost growth has no meaningful effect on goods or housing services inflation.

Let's personalize your content