Round Trip

The Big Picture

AUGUST 1, 2023

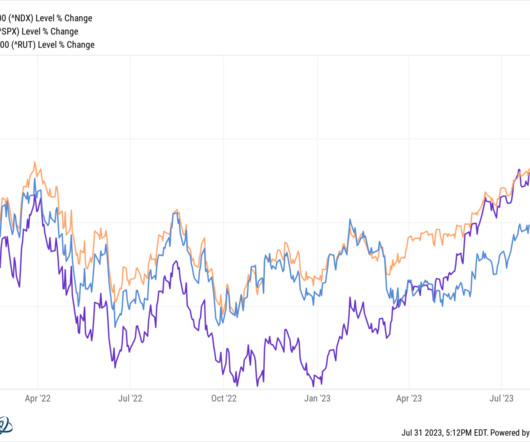

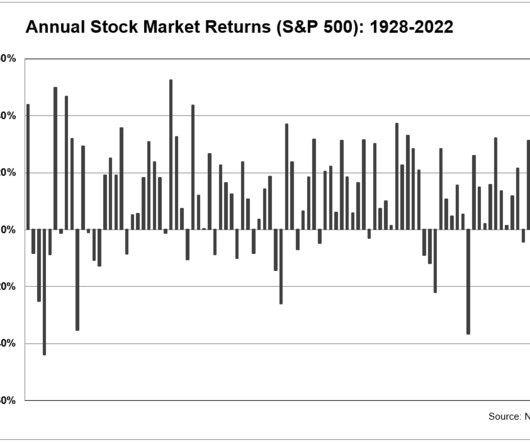

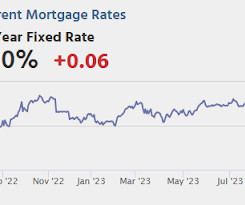

After a monstrous 68% recovery from the March 2020 pandemic low, and another nearly 30% gain in 2021, markets decided to have one of their all-too-regular spasms. Blame whatever you want – Too far, too fast? End of ZIRP? Too rapid rate increases? – but the giveback off the highs was substantial: S&P 500 was down ~23%, Russell 2000 was off 27%, and the Nasdaq 100 came down 32%.

Let's personalize your content