10 Friday AM Reads

The Big Picture

MAY 5, 2023

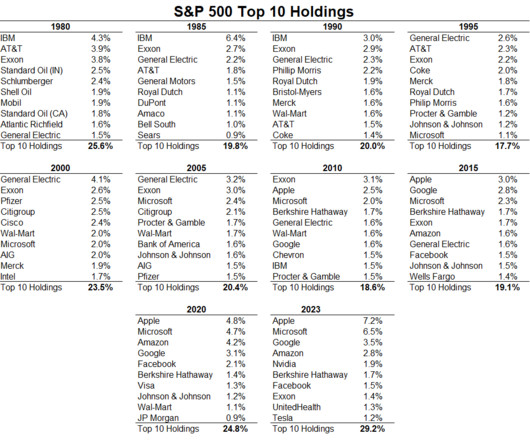

My end-of-week morning NFP train WFH reads: • Warren Buffett’s Formula for Success: One Good Decision Every Five Years : Berkshire Hathaway has obliterated the market in his 58 years at the company. He credits roughly 12 decisions. ( Wall Street Journal ) see also The 10 Greatest US Investors and the Virtues That Made Them : There can be few fields of human endeavor in which history counts for so little as in the world of finance.

Let's personalize your content