Saturday links: our information diets

Abnormal Returns

JANUARY 27, 2024

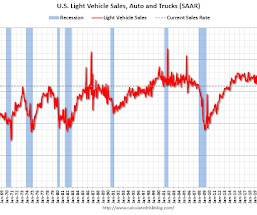

EVs EVs may have hit a bit of a bump in the road, but they are still the future. (wsj.com) Why Americans are opting for hybrids. (bonddad.blogspot.com) Looking at new EV? Think about leasing it. (wsj.com) Auto insurance Why car insurance premiums are soaring. (bloomberg.com) Auto insurance companies having no problem pushing through higher rates. (wsj.com) Nuclear Why uranium prices are surging.

Let's personalize your content