10 Thursday AM Reads

The Big Picture

JULY 13, 2023

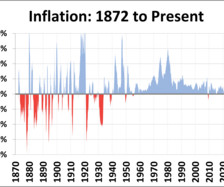

My morning train reads: • Stocks Took an 18-Month Round Trip From Tech Bear to AI Bull : The same handful of megacap names that led the market down have been powering the latest surge. ( Businessweek ) • Inflation Cools Sharply in June, Good News for Consumers and the Fed : The Consumer Price Index climbed far more slowly in June, a relief for shoppers and a hopeful — though inconclusive — sign that America might pull off a “soft landing.” ( New York Times ) see also Inflation drops to lowest le

Let's personalize your content