REITs Report Strong Balance Sheets During the Latest Quarterly Results

Wealth Management

SEPTEMBER 12, 2023

Publicly-traded REITs are largely relying on unsecured debt at fixed rates, avoiding some of the rancor caused by rising interest rates.

Wealth Management

SEPTEMBER 12, 2023

Publicly-traded REITs are largely relying on unsecured debt at fixed rates, avoiding some of the rancor caused by rising interest rates.

Calculated Risk

SEPTEMBER 12, 2023

Notes: This CoreLogic House Price Index report is for July. The recent Case-Shiller index release was for June. The CoreLogic HPI is a three-month weighted average and is not seasonally adjusted (NSA). From CoreLogic: Annual US Home Price Growth Rebounds in July, CoreLogic Reports • U.S. home price gains moved up to 2.5% year over year in July, marking the 138th consecutive month of annual growth. • Eleven states saw home price declines on an annual basis in July, ranging from -5.7% in Idaho to

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

SEPTEMBER 12, 2023

By combining the right strategies and embracing change, RIAs can adapt to the evolving market landscape and create a legacy that withstands the test of time.

Calculated Risk

SEPTEMBER 12, 2023

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in August A brief excerpt: This is the second look at local markets in August. I’m tracking a sample of about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

SEPTEMBER 12, 2023

The businesses will pay a combined $850,000 for allegedly using hypothetical performance in advertising without updating their policies and procedures to comply with the rule.

Abnormal Returns

SEPTEMBER 12, 2023

Macro stuff It's hard building macro models given all the data revisions. (mrzepczynski.blogspot.com) Why revisions to price indices can be large. (libertystreeteconomics.newyorkfed.org) Fixed income A look at bond market returns during a yield curve inversion. (thinkadvisor.com) There are different ways to measure fixed income factors. (insights.finominal.com) Liquid alts How to replicate managed futures funds.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

SEPTEMBER 12, 2023

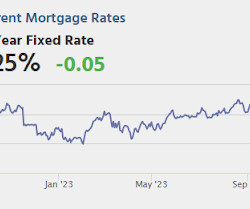

From Matthew Graham at Mortgage News Daily: Mortgage Rates Jump Higher Mortgage rates are noticeably higher to start the new week for most lenders although some lenders increased their costs nearly as much on Friday. Between the two business days (banks were closed on Monday), the average lender is up between 0.125% and 0.25% from Thursday afternoon. [ 30 year fixed 7.21% ] emphasis added Wednesday: • At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage

Wealth Management

SEPTEMBER 12, 2023

President Thomas Carroll will take over the role from Andy Berg on Jan. 1.

Calculated Risk

SEPTEMBER 12, 2023

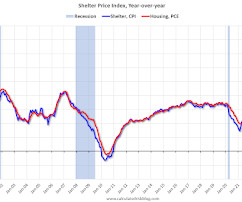

Tomorrow the BLS will release inflation data for July. The consensus is for a 0.6% increase in CPI, and a 0.2% increase in core CPI. The consensus is for CPI to be up 3.6% year-over-year (up from 3.3% in July) and core CPI to be up 4.3% YoY (down from 4.7% in July). Here is a preview from Goldman Sachs economists Manuel Abecasis and Spencer Hill: We expect a 0.24% increase in August core CPI (vs. 0.2% consensus), corresponding to a year-over-year rate of 4.30% (vs. 4.3% consensus).

Wealth Management

SEPTEMBER 12, 2023

With the “free money” well running dry, compliance is one area that heavily regulated firms should think long and hard about before cutting to conserve cash.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

The Big Picture

SEPTEMBER 12, 2023

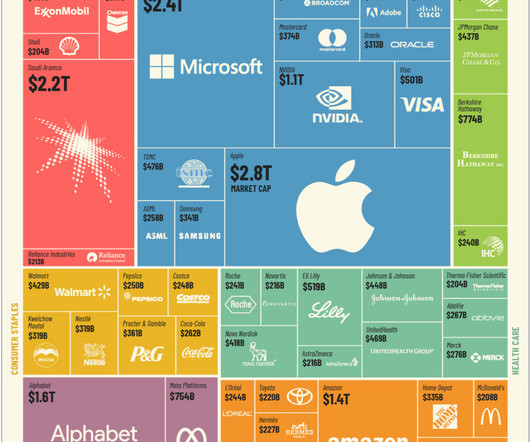

The 50 Most Valuable Companies in the World in 2023 The post Most Valuable Companies appeared first on The Big Picture.

Wealth Management

SEPTEMBER 12, 2023

Wednesday, September 27, 2023 | 4:15 PM ET

Nerd's Eye View

SEPTEMBER 12, 2023

Welcome back to the 350th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Jason Wenk. Jason is the CEO of Altruist, a relatively new RIA custodian that has quickly grown to serve more than 3,500 advisory firms across the country, making it the 4th-largest independent RIA custodian by firm count. What's unique about Jason, though, is how he built Altruist as an "all-in-one" custodian platform for RIAs that includes the portfolio management and performance reporti

The Big Picture

SEPTEMBER 12, 2023

The transcript from this week’s, MiB: Jon McAuliffe, the Voleon Group , is below. You can stream and download our full conversation, including any podcast extras, on iTunes , Spotify , Google , YouTube , and Bloomberg. All of our earlier podcasts on your favorite pod hosts can be found here. ~~~ XXXXX ~~~ The post Transcript: Jon McAuliffe appeared first on The Big Picture.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Wealth Management

SEPTEMBER 12, 2023

Investors have snapped up more than $1 trillion of Treasury Bills in just the last three months.

Alpha Architect

SEPTEMBER 12, 2023

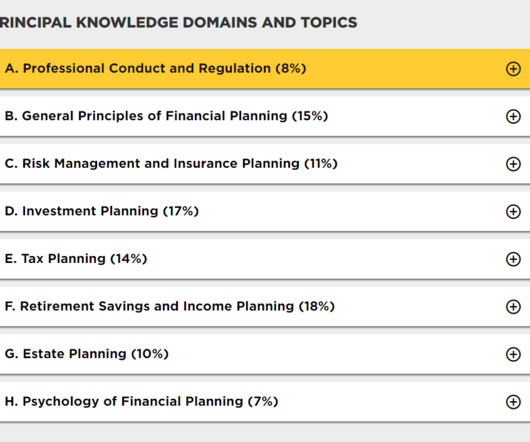

Let’s talk about the right approach(es) and the proper study techniques you need to pass the CFPⓇ exam with confidence and get the certification you need to advance your career in finance and investing. How to Crush the CFPⓇ Exam ?: Part 1 was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Advisor Perspectives

SEPTEMBER 12, 2023

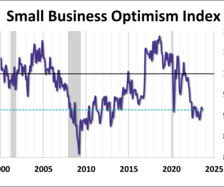

The headline number for the NFIB Small Business Optimism Index decreased to 91.3 in August, as small business owners continued to report inflation as their biggest problem. The latest reading was worse than the forecast of 91.6 and marked the 20th consecutive month the index has been below the series average of 98.

A Wealth of Common Sense

SEPTEMBER 12, 2023

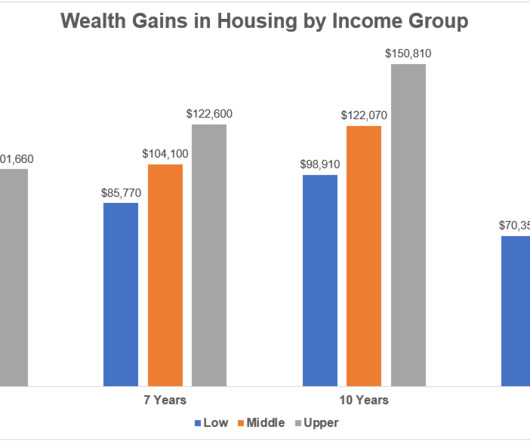

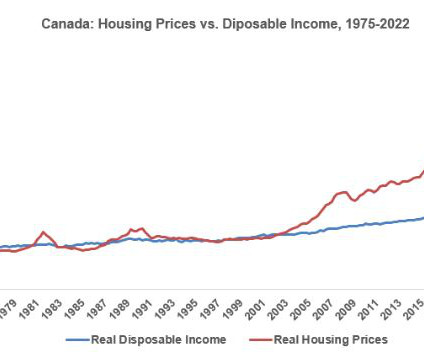

According to the National Association of Realtors, the median price of a house in the United States is worth $190,000 more than it was a decade ago. If you’ve owned a house for more than 3 years or so, you’re likely sitting on some nice gains. Those gains were not evenly distributed but across the various income levels, homeowners have made a good chunk of change: The pandemic-related housing gains are unlik.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Million Dollar Round Table (MDRT)

SEPTEMBER 12, 2023

By Louis Andrew Ang Gimenez As I look back on my journey of embarking on my second career as a financial advisor, it was daunting. I started from nothing, and I had a family who depended on me. I needed to quickly get on my feet. By learning how to use H.I.G.H. to continuously and consistently focus on my whys in growing the business, I was able to support my family and qualify for MDRT.

Trade Brains

SEPTEMBER 12, 2023

Best Harmonic Patterns : Chart patterns are an important tool of technical analysis for traders to build strategies with a better understanding of price movements. Harmonic patterns are the type of chart patterns formed more precisely with price movements to identify the accurate entry, stop loss and targets in security. Here we shall discuss the meaning of Harmonic patterns and the 5 best harmonic patterns to trade with their formation and entry/exit opportunities.

Diamond Consultants

SEPTEMBER 12, 2023

How to think about transition deals when evaluating a firm or model: 5 key considerations. Why do advisors switch firms? Most industry experts could rattle off a laundry list of reasons: more freedom and control, the ability to serve clients better, access to a greater array of products and services, better work-life situation for the advisor and team…the list goes on.

Random Roger's Retirement Planning

SEPTEMBER 12, 2023

Steve Laipply from iShares was on ETFIQ on Bloomberg Monday talking primarily about fixed income ETFs. Included in iShares fixed income lineup are three bond ETF buywrite funds. So the iShares 20+ Year Treasury Bond Buywrite ETF (TLTW) essentially owns TLT, a long duration bond fund, and sells covered calls against the shares of TLT. iShares also has Investment Grade Corporate Bond Buywrite ETF (LQDW) which corresponds to LQD and there is also the iShares High Yield Bond Buywrite ETF (HYGW) whic

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

The Irrelevant Investor

SEPTEMBER 12, 2023

Today’s Animal Spirits is brought to you by YCharts: See here for YCharts latest product enhancement webinar covering the proposal tool with RWM COO Nick Maggiulli and here for a month of free access with YCharts! On today’s show, we discuss: Apple tests limits for most expensive iPhones AI – The hot stocks of the decade? Tropical Bros Shirts: See here for Animal Spirits x Tropical Bros shirts and here for m.

Aleph

SEPTEMBER 12, 2023

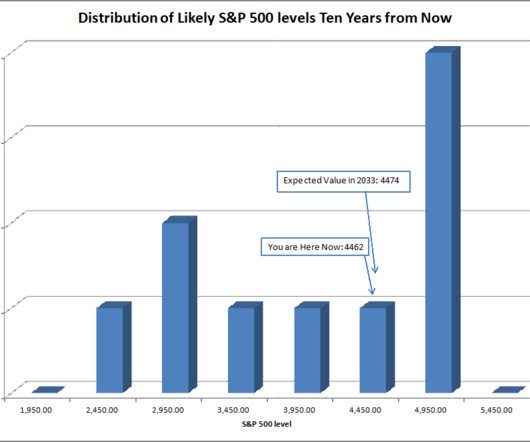

Image Credit: Aleph Blog || Has the return on assets for public equities permanently risen? The return on bonds has risen for now. From the last piece: “At March 31st, 2023, the S&P 500 was priced to return 2.41%/year over the next ten years. Given the rally since then, that return has shrunk to 0.49%/year. Currently the 10-year Treasury yields 3.76%.

Advisor Perspectives

SEPTEMBER 12, 2023

Why has there been a reluctance within the advisory profession to actively collect, much less leverage client experience feedback?

Conneqtor

SEPTEMBER 12, 2023

In the ever-evolving landscape of financial advice, where trust and competence are paramount, providing extraordinary service & engagement can be your key to success and a way to set yourself apart from competitors. Let’s start with the question: why does exceptional service and engagement matter in the world of financial advice?

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Advisor Perspectives

SEPTEMBER 12, 2023

“Spray-and-pray” marketing is a good model for selling t-shirts – not so good for getting advisory clients.

Trade Brains

SEPTEMBER 12, 2023

What an exciting week it’s been! A historic day for India’s stock market! The last time people were this excited was when MRF, a famous tire company, crossed the Rs. 1 crore mark. On September 11, Nifty 50 reached a massive 20,000 points, rising almost 1% from the previous day. This journey to 20,000 has taken a long time. Nifty 50 first hit 10,000 on July 26, 2017, and it took more than 21 years to double that number.

Advisor Perspectives

SEPTEMBER 12, 2023

Understanding and managing your firm’s practice growth multiplier is your ticket to enduring success, higher profits, and a more rewarding practice.

SEI

SEPTEMBER 12, 2023

Monthly Market Commentary for August 2023.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content