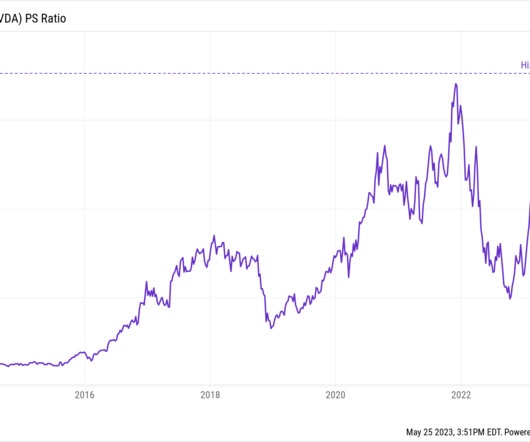

Nvidia Breaks Away

The Reformed Broker

MAY 26, 2023

Welcome to the latest episode of The Compound & Friends. This week, Michael Batnick, Dror Poleg, and Downtown Josh Brown discuss Nvidia’s ascent, the AI explosion, the future of work, and much more! You can listen to the whole thing below, or find it wherever you like to listen to your favorite pods! Listen here: Apple podcasts Spotify podcasts Google podcasts Everywhere else!

Let's personalize your content