10 Thursday AM Reads

The Big Picture

JULY 27, 2023

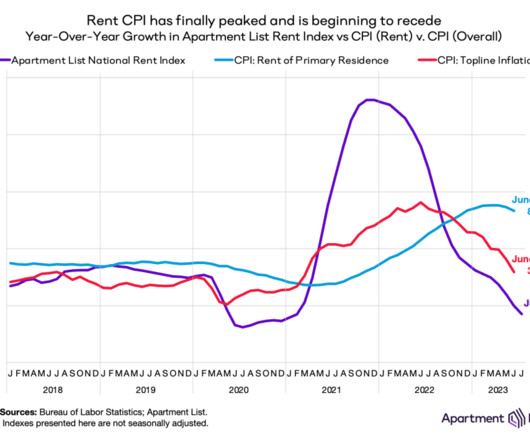

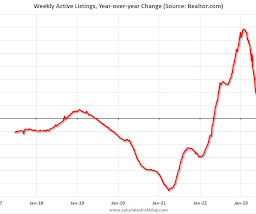

My morning train reads: • Commercial Real Estate Is in Trouble, but Not for the Reason You Think : As far as weak spots go, there are reasons for concern. Offices comprise 80% of new delinquencies in commercial real estate loans, and occupancy rates in major cities consistently hover around 50% of capacity. But the towers we once commuted to comprise just a tiny fraction of the overall commercial real estate market.

Let's personalize your content