Friday links: feelings of FOMO

Abnormal Returns

MARCH 1, 2024

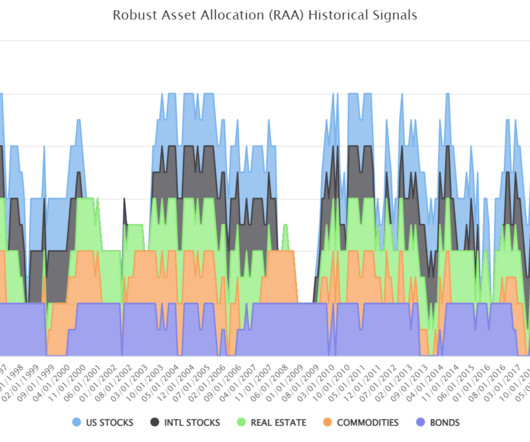

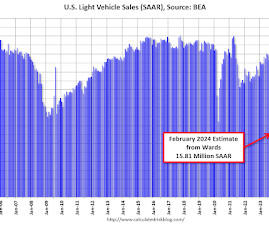

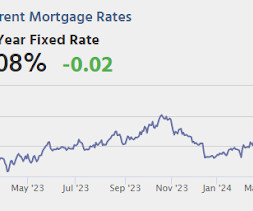

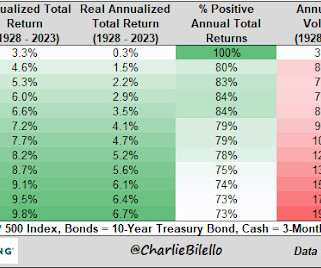

February 2024 A look at asset class performance for February 2024. (allstarcharts.com) Small cap stocks are still down on the year. (on.spdji.com) The momentum factor had a big month. (mrzepczynski.blogspot.com) Markets What's the biggest risk right now? (awealthofcommonsense.com) Stock market concentration is the norm. (acadian-asset.com) Crypto Bitcoin is now worth two Teslas ($TSLA).

Let's personalize your content