Friday links: spending time together

Abnormal Returns

SEPTEMBER 29, 2023

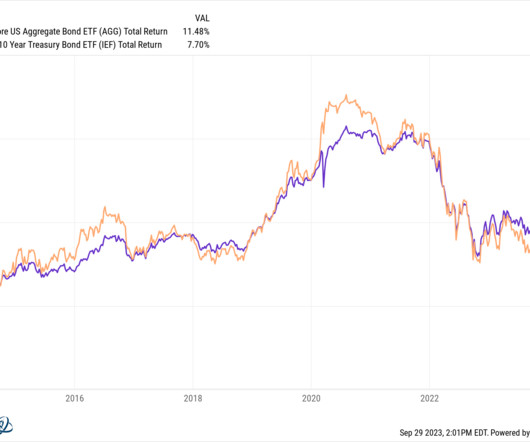

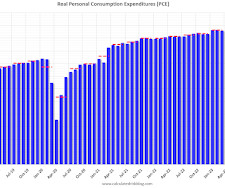

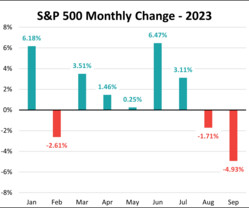

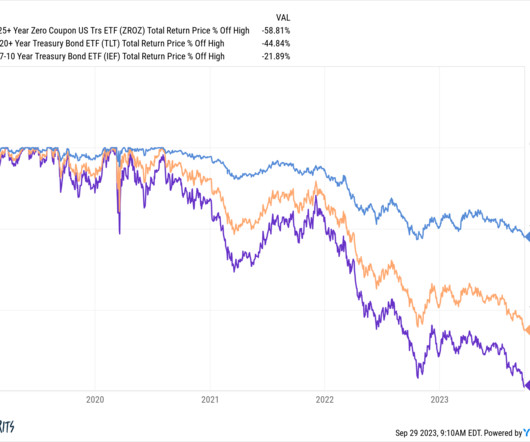

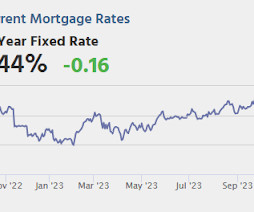

Rates (Rising) interest rates are driving everything these days. (allstarcharts.com) Despite recent losses, investors are pouring money into bond funds. (theirrelevantinvestor.com) Strategy Everything lined up against the stock market in September. (carsongroup.com) Cash is an actual hedge against stock market declines. (priceactionlab.com) Companies Brian Barrett, "Amazon is now less of a store than a mall, or maybe a sprawling bazaar.

Let's personalize your content