Top clicks this week on Abnormal Returns

Abnormal Returns

DECEMBER 24, 2023

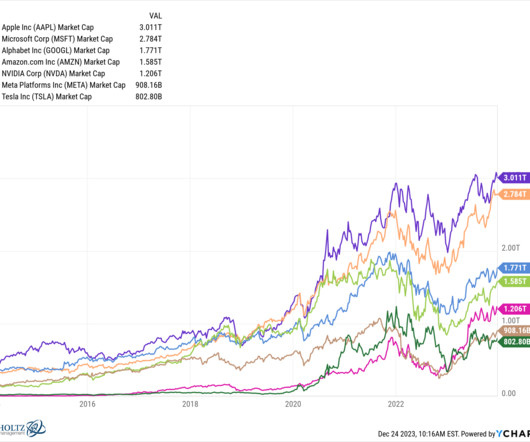

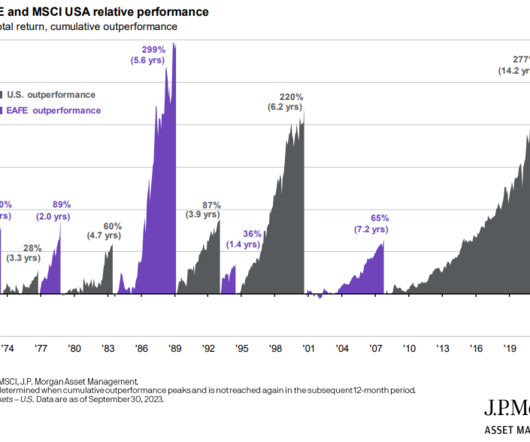

Top clicks this week Six charts that defined markets in 2023. (axios.com) If you're such a great trader why are you spending all your time and effort selling a trading course? (ofdollarsanddata.com) Ben Carlson, "I will never understand the permabear mindset – these people that prey on the fears of others for personal gain." (awealthofcommonsense.com) What do you get when you combine momentum and quality?

Let's personalize your content