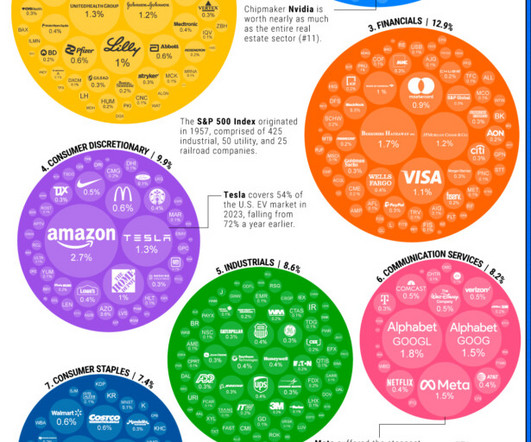

S&P 500 Companies: A Visual Breakdown

The Big Picture

JUNE 28, 2023

All of the companies in the S&P 500 are worth $7.1 trillion in assets, accounting for close to 80% of available market capitalization on U.S. stock exchanges. Visual Capital notes: “Over the last decade, big tech names have dominated the index. The tech sector makes up over 26% , with Apple, Microsoft, and Nvidia as the top S&P 500 companies by market capitalization.

Let's personalize your content