Economic uncertainty has those closest to retirement delaying their plans

Nationwide Financial

JUNE 20, 2023

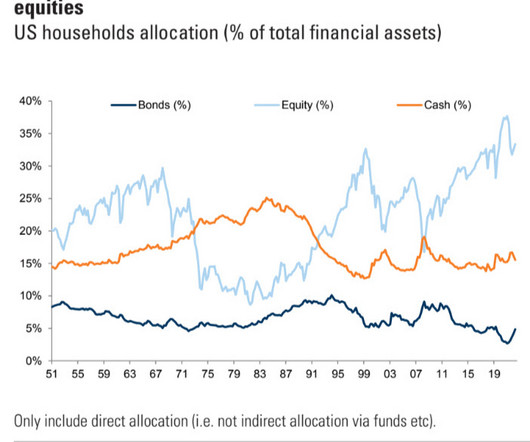

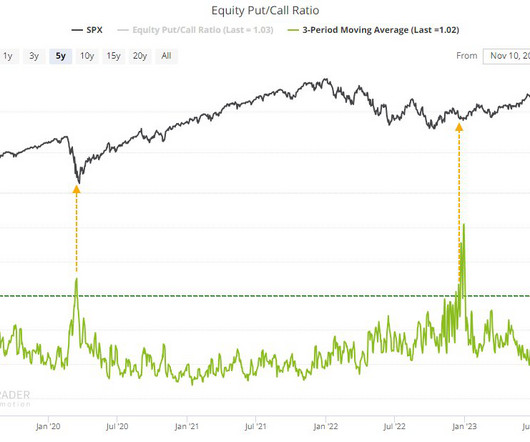

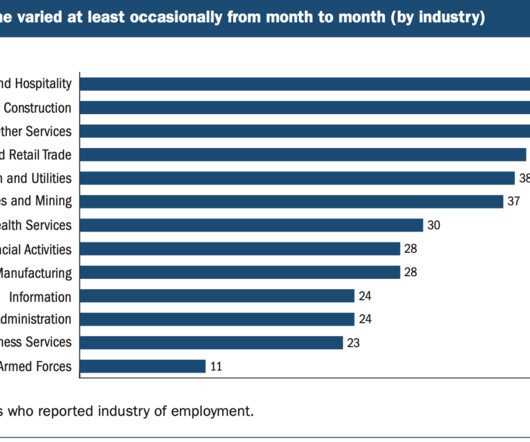

After decades of saving and planning, many pre-retirees (non-retired investors aged 55-65) are reconsidering their retirement plans in response to rising inflation, high interest rates, and an uncertain economic environment. The biggest threat to a secure retirement? The biggest threat to a secure retirement?

Let's personalize your content