The Twin Pillars of Required IRA Distributions to a Trust

Wealth Management

MAY 19, 2025

Allocating between principal and income portfolios.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

MAY 19, 2025

Allocating between principal and income portfolios.

Nerd's Eye View

OCTOBER 20, 2022

In recent years, politically charged topics have become the forefront of news and media, and with the rise of access to digitally distributed media, it has become commonplace for clients to have concerns about the possible impact of political events on their portfolios.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Protect What Matters: Rethinking Finance Ops In A Digital World

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Nerd's Eye View

MARCH 28, 2025

Also in industry news this week: A recent survey indicates that younger "DIY" investors are more likely to be interested in working with a human advisor than their older counterparts, suggesting an opportunity for advisors to tap into this demographic (perhaps by setting minimum planning fees that ensure these clients can be served profitably today (..)

Abnormal Returns

AUGUST 13, 2024

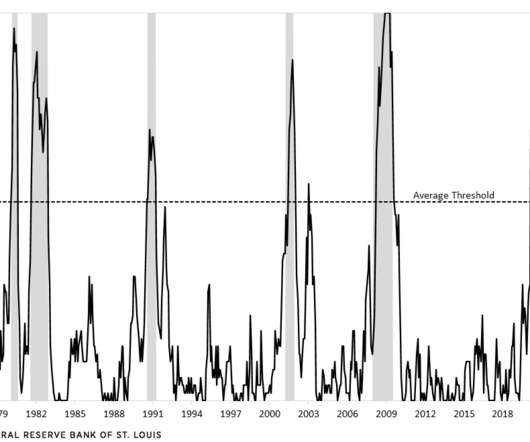

Venture capital There is nothing normal about the distribution of angel investment returns. blogs.cfainstitute.org) How VCs drive media coverage of their portfolio companies. papers.ssrn.com) Research How long can stocks underperform inflation? ofdollarsanddata.com) Retail trading frenzies can have real world impacts.

The Big Picture

OCTOBER 24, 2024

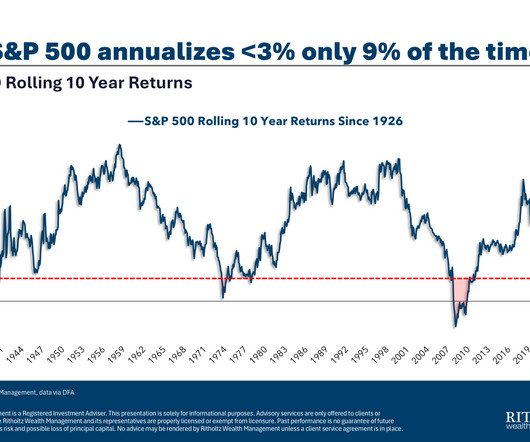

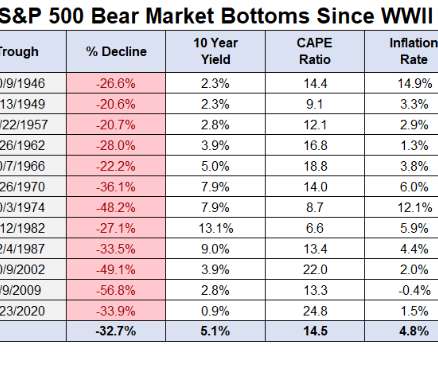

Investors should be prepared for equity returns during the next decade that are towards the lower end of their typical performance distribution relative to bonds and inflation.” Of course, you can find other forecasts that are friendlier to your portfolio, For example, JP Morgan sees U.S. They expect ~3% a year (or worse) annually.

Trade Brains

NOVEMBER 6, 2024

These companies manage profitable real estate portfolios across various sectors. REITs collect rent from these properties and distribute profits to investors through dividends. Portfolio Diversification: Through REITs, investors gain exposure to various property types. Therefore, investors can count on consistent passive income.

Nerd's Eye View

JANUARY 4, 2023

And when it comes to retirement planning, one popular technique is the use of ‘guardrails’, which set an initial monthly withdrawal rate that can be later adjusted as the size of the client’s portfolio changes. If the portfolio balance declines due to excess distributions (e.g.,

Nerd's Eye View

DECEMBER 4, 2024

Additionally, private funds can employ leverage, short selling, derivative strategies, and other methods to further manage the portfolio's risk and return characteristics. generally those with over $200,000 of income or $1 million in net worth) are allowed to invest in private funds.

The Big Picture

DECEMBER 4, 2024

But suddenly they find themselves sitting on an uncomfortably large percentage of their portfolio in a single name. To help us unpack all of this and what it means for your portfolio Let’s bring in Meb Faber He’s the founder and chief investment officer of Cambria. Perhaps they have some founder stock from a startup.

Nerd's Eye View

DECEMBER 7, 2022

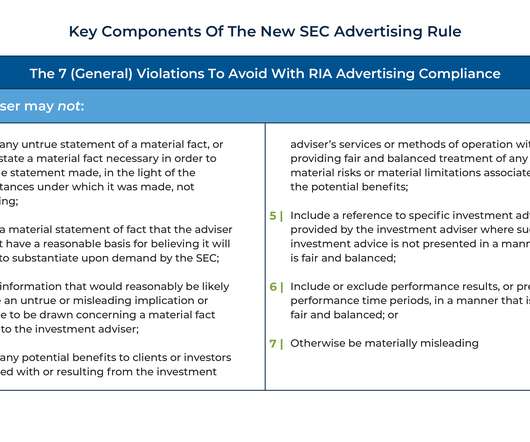

The Marketing Rule also requires performance results to be presented consistently over 1-, 5-, and 10-year time periods (or the time period the portfolio has existed, if shorter than a particular prescribed period) preventing advisers from cherry-picking time periods that would make their returns appear more favorable.

Wealth Management

JUNE 20, 2025

There is something to be said for owning your own distribution channel,” he said. “What works really well for us and going back to growth, referrals are too hard, all the steps in a referral, when you give them [advisors] a branded mobile app of their own that they can show, the response is often: ‘oh I want that,’” said Fields.

NAIFA Advisor Today

OCTOBER 10, 2024

New NAIFA member, Alexander Flecker, CFP, CIMA , Head of Distribution at Measured Risk Portfolios , shares insights into his journey in the financial services industry and the firm's rapid growth since joining in mid-2023.

Trade Brains

NOVEMBER 11, 2023

Zee earns money through advertising, subscription services, content licensing, theatre productions, music licensing, and movie distribution. Its domestic broadcast portfolio includes over 48 channels. The Company’s 41-channel international broadcast portfolio is available in over 170 countries. stake which is worth Rs.

Abnormal Returns

JANUARY 27, 2023

awealthofcommonsense.com) 2022 shows that every portfolio strategy comes under pressure. morningstar.com) Taxable distributions in a down year is a double-whammy. Strategy The investment landscape has completely transformed in the past century. portfoliocharts.com) Why so many investors get caught up in return chasing.

Trade Brains

NOVEMBER 23, 2023

Best RK Damani Portfolio Stocks: Investing in the stock market can be a daunting task, given the sheer number of stocks available to choose from. To simplify things, many investors follow the portfolio of successful investors such as RK Damani, who has amassed a fortune through stock investments. Who is RK Damani? Stock P/E 106.27

Nerd's Eye View

JANUARY 13, 2023

From there, we have several articles on retirement planning: The latest rules for 2023 Required Minimum Distributions from inherited retirement accounts. We also have a number of articles on investment planning: A recent study indicates that rebalancing a portfolio on an annual basis is superior to longer or shorter time horizons.

Wealth Management

JUNE 20, 2025

Davis Janowski , Senior Technology Editor, WealthManagement.com June 20, 2025 5 Min Read Dr. Naomi Win, a behavioral finance analyst at Orion, gave a presentation entitled, “Aligning Lives and Portfolios: Meeting the Moment for Modern Investors” at Wealth Management EDGE. Given the title, I was at first worried, but her talk was fascinating.

Trade Brains

SEPTEMBER 17, 2023

Best Porinju Veliyath Portfolio Stocks: Investors are always on the lookout for small-cap companies which can lead to multi-bagger returns. In this article, we’ll read about such best Porinju Veliyath portfolio stocks. In this article, we’ll read about such best Porinju Veliyath portfolio stocks. EPS ₹8 Stock P/E 196 RoE 3.2%

Abnormal Returns

JANUARY 3, 2023

capitalspectator.com) 2022 was the third worst year for the 60/40 portfolio. abnormalreturns.com) Adviser links: forced distributions. Markets How major asset classes performed in December 2022. awealthofcommonsense.com) The Dow lead the major indices in 2022. abnormalreturns.com) What you missed in our Sunday linkfest.

Trade Brains

SEPTEMBER 14, 2023

GQG’s investment team uses a thorough and unrestricted approach to equity research, building portfolios that are different from their respective benchmarks to concentrate on distinctive business aspects like revenue stream diversity and disruption risk. Adani Green presently has a portfolio of 54 operational projects across 12 Indian states.

Yardley Wealth Management

FEBRUARY 18, 2025

Traditional Investment Strategies The Role of Income Tiers and Priority Levels Case Studies Key Considerations Conclusion Introduction Waterfall Wealth Management is a financial strategy designed for high-net-worth individuals seeking a structured, prioritized approach to wealth distribution.

Nerd's Eye View

FEBRUARY 23, 2024

Also in industry news this week: A recent study has found that advisors who gain additional credentials tend to see a boost both in their confidence and in their business metrics, with the CFP certification standing out in terms of value The implications for RIAs of a proposed Treasury Department rule that would subject many firms to certain anti-money-laundering (..)

Abnormal Returns

JULY 19, 2022

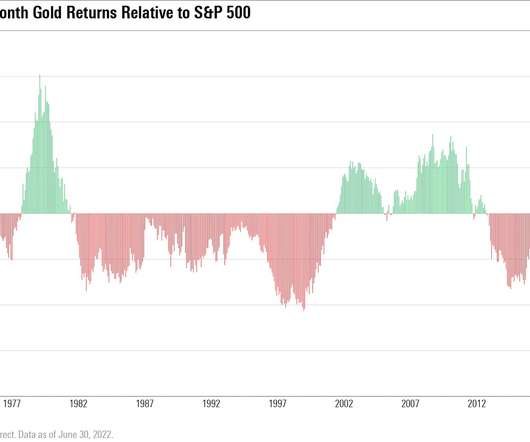

Portfolio management Byrne Hobart, "Inverse correlations tend to go away when people rely on them. thediff.co) Concentrated portfolios are at-risk of missing out on overall equity market gains. evidenceinvestor.com) What's the best way to take distributions from a portfolio? stock returns from 1963-2020.

Trade Brains

AUGUST 18, 2023

Best Vijay Kedia Portfolio Stocks: Many investors keep a close eye on stock buys and sales of ace investors for ideas and inspiration. In this article, we’ll look at the best Vijay Kedia portfolio stocks and see if they can be an interesting opportunity for us as well. Who is Vijay Kedia? He calls his investment philosophy ‘SMILE’.

Nerd's Eye View

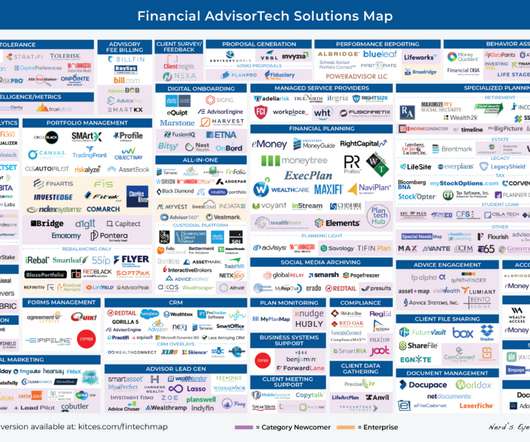

AUGUST 1, 2022

AssetMark acquires Adhesion Wealth from Vestmark as TAMPs continue to seek scale for both technology development and distribution. CapIntel raises an $11M Series A round to bring its proposal generation tools from Canada to the US.

Nerd's Eye View

MAY 1, 2023

only' checking client portfolios for tax-loss harvesting every other day, after having advertised daily checks) – a first for the SEC in scrutinizing an RIA not for failing to execute its investment promises to clients, but for failing to execute tax-loss harvesting promises instead.

Trade Brains

OCTOBER 4, 2023

The company has a PAN India distribution present in 9.5 The post Top Stocks Held by Quant Small-Cap Fund – Portfolio Analysis appeared first on Trade Brains. International markets that the corporation has sold its goods to include those in North America, Europe, the Middle East, Africa, and Asia-Pacific. Stock P/E (TTM) 78.95

Nerd's Eye View

JUNE 25, 2024

In this episode, we talk in-depth about Chris's efficient planning process, including how he works through clients' financial plans collaboratively during their annual meetings and sends them a final copy afterward (instead of conducting a lot of time-intensive plan preparation in advance), how Chris used to do in-depth cash flow analyses with his (..)

Nerd's Eye View

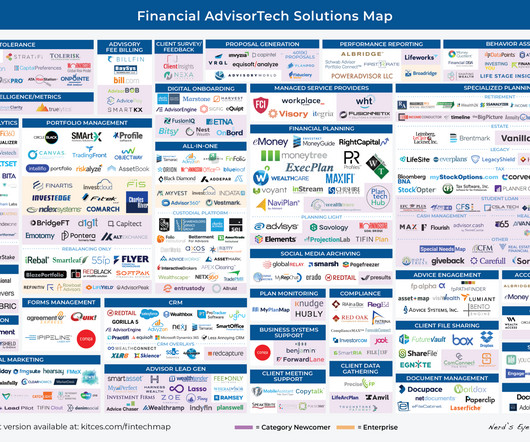

JUNE 21, 2023

While most of the Rule’s requirements are relatively straightforward, there are detailed nuances that IAR advisers must be familiar with to enforce their own codes of ethics pursuant to the SEC’s rule. .

Trade Brains

JULY 3, 2025

lakh crores across its segment like, Mutual Funds (Active & Passive), Portfolio Management Services (‘PMS’) and Category-III Alternative Investment Funds (‘AIFs’). The Company offers a range of services, including retail and institutional broking, and financial products distribution.

The Big Picture

OCTOBER 30, 2024

And on today’s edition of At the Money, we’re going to discuss how you can participate in shareholder yield and get more out of dividends to help us unpack all of this and what it means for your portfolio. Let’s bring in Meb Faber founder and CIO of Cambria. And any given year since then, there’s been more buybacks.

The Big Picture

MARCH 10, 2025

” A : The standard answer is Accumulation, Maintenance Distribution , but let’s dig deeper. The GFC I had a more money at risk; Covid was fully invested, with a 401k, portfolio and of course, the firm. .” Q :“ How does our relationship with money change during different life phases?

Trade Brains

JUNE 24, 2025

Shares of a company involved in exporting, marketing & distributing finished formulations of pharmaceutical drugs and API surged nearly 3 percent on Tuesday, after the company announced record date for bonus issue in 1:1 ratio. With a market cap of Rs. 1,076 crores, at 02:51 p.m., 1,826 on NSE, up by around 1.5

Trade Brains

NOVEMBER 3, 2024

These companies deliver exceptional financial performance while maintaining robust credit portfolios. Bajaj Finance’s comprehensive product portfolio caters to diverse customer segments, strengthening its market presence. Shriram Finance’s extensive distribution network enhances market reach and customer accessibility.

Carson Wealth

MARCH 21, 2025

An endowment is a portfolio of assets that is invested to provide support for a cause. You can specify that a certain (typically low) percentage of the assets are to be distributed and used by the specified charities each year. The usage policy establishes the purposes for which the charity can use the fund distributions.

Brown Advisory

SEPTEMBER 21, 2022

Resilience is Core to Sustainable Portfolio Construction. While the old adage “only time will tell” generally refers to a future outcome, it is apropos of our belief that a truly sustainable portfolio must consist of businesses that have proven to be resilient under a variety of macroeconomic circumstances. Wed, 09/21/2022 - 10:50.

The Big Picture

FEBRUARY 2, 2024

He manages the focused quality fund and its new Quality ETF, and is the portfolio manager for quality strategies. Hancock is also portfolio manager for GMO’s Quality Strategies, including the Quality Fund MF ( GQETX ); that fund manages >8$ billion dollars and over the past 20 years, has returned 13.6%

The Big Picture

NOVEMBER 26, 2024

To help us unpack all of this and what it means for your portfolio, let’s bring in Matt Hogan. And so our distribution team sits under that. And the second, is you need to size your portfolio appropriately. If I’m an investor and I want to put 2 or 3% of my portfolio into coins, what do I do?

Trade Brains

JUNE 23, 2025

The shares of this leading gas distribution company are in focus after it reported a robust fourth quarter and FY25 performance, and several analysts believe in its long-term performance. The company also has 55 percent oil-linked gas in its portfolio, and expects to maintain strong margins in the future.

Trade Brains

JULY 6, 2025

The stocks to watch out for are listed below Varun Beverages Ltd Varun Beverages Ltd is one of the largest franchisees of PepsiCo globally, responsible for producing and distributing a wide range of carbonated soft drinks, juices, and bottled water. Founded in 1942, it has expanded its footprint to numerous countries.

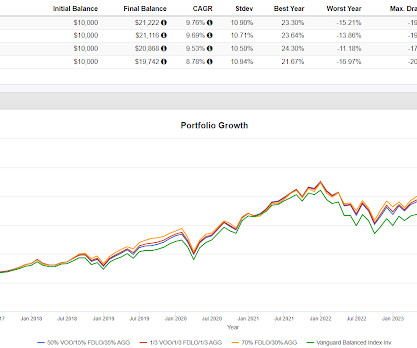

Random Roger's Retirement Planning

NOVEMBER 28, 2024

I would describe the paper as seeking how to use low volatility equities in various ways to replace some or all of a traditional 60% equities/40% bonds portfolio. All three portfolios outperform VBAIX which is a proxy for a 60/40 portfolio and they do so with lower volatility and better Sharpe Ratios.

Harness Wealth

APRIL 28, 2025

Partnerships utilize Form 1065 Schedule K-1 S corporations issue Form 1120S Schedule K-1 Trusts distribute Form 1041 Schedule K-1, each tailored to reflect the unique characteristics of these business structures. Many funds, partnerships, and complex entities distribute K-1s perilously close to, or even after, individual filing deadlines.

The Big Picture

JULY 8, 2023

When she returned to Franklin Templeton, she rotated through various divisions, including investment management, distribution, technology, operations, and high-net-worth. We also discussed active management versus indexing: “If you are an active manager, your job is to have a diversified portfolio and think about risk-adjusted returns.

The Irrelevant Investor

OCTOBER 18, 2022

See here for more info on Composers’ new one-click, systematically managed portfolio On today’s show we discuss: Fun stats from Nick Colas Distribution of household wealth in the US since 1989 Yardeni on S&P profit margins Plans for a 24-story tower in Grand Rapids canceled Rich.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content