Distributions of Stock in a GRAT Don’t Trigger Insider Trader Rules

Wealth Management

JULY 2, 2025

Number 8860726.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JULY 2, 2025

Number 8860726.

Carson Wealth

MAY 7, 2025

You can take your time, however, deciding how you want to distribute the donations, which meanwhile can potentially grow tax-free within the account. These entities have more freedom in granting than other charitable giving vehicles and can distribute donations to individuals, not just to qualified charitable organizations. 7767505.1

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JUNE 20, 2025

There is something to be said for owning your own distribution channel,” he said. Number 8860726.

Nerd's Eye View

DECEMBER 4, 2024

However, it's also possible for advisors to launch and manage their own private funds, which can allow them to further tailor their investment strategy to their clients' needs and to grow their business by attracting more high-net-worth clientele, while potentially cutting out some of the cost layers that clients face when using third-party alts distribution (..)

Nerd's Eye View

JANUARY 13, 2023

FINRA has released its enforcement priorities for 2023, including a continued focus on compliance with Regulation Best Interest as well as several new priority topics, such as manipulative trading, fixed-income pricing, and trading in fractional shares.

Nerd's Eye View

JUNE 21, 2023

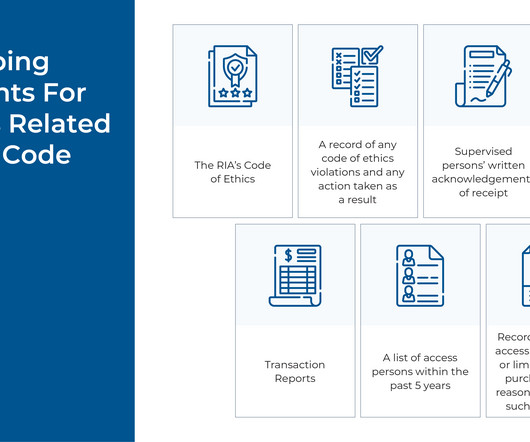

In addition to collecting the required reports, the firm’s Chief Compliance Officer (CCO) also has certain review requirements.

MainStreet Financial Planning

NOVEMBER 8, 2024

Establishing a donor-advised fund allows you to make a large charitable contribution in one year, receive the tax deduction, and distribute funds to charities over time. This strategy is particularly effective if you have appreciated securities, as donating them can help you avoid capital gains taxes.

Nerd's Eye View

JANUARY 1, 2024

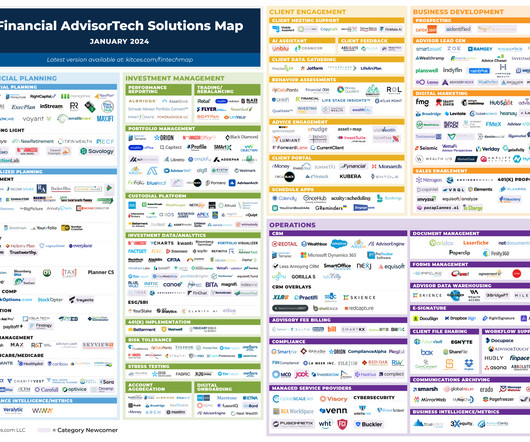

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including: JPMorgan has announced plans to shut down its robo-advisor offering after just four years, highlighting broadly the challenges of robo-advisors to overcome the challenging economics of acquiring and serving small clients, and in (..)

Harness Wealth

APRIL 28, 2025

Partnerships utilize Form 1065 Schedule K-1 S corporations issue Form 1120S Schedule K-1 Trusts distribute Form 1041 Schedule K-1, each tailored to reflect the unique characteristics of these business structures. Many funds, partnerships, and complex entities distribute K-1s perilously close to, or even after, individual filing deadlines.

Wealth Management

JUNE 20, 2025

Each discussed how providing a more holistic approach to distribution-phase planning in their practices can amp up organic growth for advisory firms. Number 8860726.

Harness Wealth

MAY 8, 2025

Whether you are contemplating forming an LP or already operate one, gaining clarity on tax matters can optimize your financial outcomes and ensure compliance with state and federal regulations. LPs are governed by a partnership agreement that outlines the roles, responsibilities, profit distribution, and other operational details.

Trade Brains

JUNE 6, 2025

Future distributions rely on WazirX profits and recovered assets. ” WazirX expressed disappointment but pledged compliance. It prioritises distributing user funds. Over 90% of voting creditors supported the plan in April. WazirX promised tokens might yield 75-80% of lost value. Zensui will now issue these recovery tokens.

Nerd's Eye View

DECEMBER 7, 2022

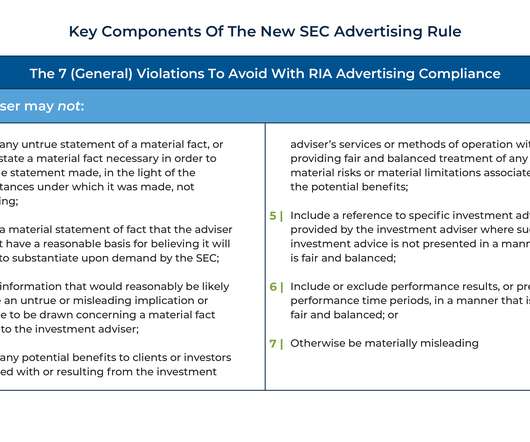

Two final prohibitions under the Marketing Rule include restrictions on the use of predecessor performance (e.g.,

Trade Brains

JUNE 22, 2025

Gokul Agro Resources Limited was established in 2014 and is a leading Indian FMCG company engaged in the production, distribution, and export of edible and non-edible oils, specialty fats, and feed meals, serving both domestic and international markets. Gokul Agro Resources Limited reported revenue of Rs. per equity share, down nearly 1.65

Harness Wealth

APRIL 16, 2025

Roth IRAs offer unique advantages including tax-free growth, no required minimum distributions during the owner’s lifetime, and potential tax benefits for heirs. The absence of required minimum distributions during the owner’s lifetime. This systematic approach ensures compliance and optimal tax outcomes.

Harness Wealth

NOVEMBER 12, 2024

HSAs give you an upfront deduction for the year of contribution, grow tax-free, and distribute tax-free, making them one of the most powerful tax-advantaged accounts. Note that gifting private company stock may require a professional appraisal to establish fair market value and ensure compliance with IRS regulations. million ($27.22

Harness Wealth

APRIL 16, 2025

For tech founders, S-corporations present a unique opportunity to optimize self-employment tax obligations through a strategic combination of reasonable salary, and distributions. Meeting safe harbor provisions requires either paying 90% of current year tax liability or 100-110% of prior year taxes, providing a clear framework for compliance.

Trade Brains

JUNE 26, 2025

This small-cap Pharma Stock, engaged in manufacturing and marketing pharmaceutical formulations and APIs, serving regulated and emerging markets with a focus on quality, compliance, and innovation, is in focus after management expected 50% growth in revenue and 100% growth in net profit for FY26. With a market capitalization of Rs.

Harness Wealth

JANUARY 9, 2025

Backdoor Roth 401(k) $23,000 ($30,500 if 50+) Allows conversion of 401(k) funds to Roth, increasing tax diversification Required Minimum Distributions apply. Mega Backdoor Roth 401(k) Up to $46,000 Higher contribution limit and increased creditor protection Required Minimum Distributions apply. Complex setup process.

Harness Wealth

MARCH 27, 2025

Instead, partners (investors) are taxed directly on their share of the fund’s income, gains, losses, and deductions, regardless of whether those amounts are actually distributed. Key provisions include: Representations and warranties about the target fund’s tax compliance and the accuracy of its tax information.

Harness Wealth

APRIL 28, 2023

If you earn income from various sources throughout the year, such as equity windfalls, venture capital fund distributions, crypto investments, and sales, or small business income, you will need to pay estimated quarterly taxes. Failing to make these payments on time can result in penalties and interest charges.

Carson Wealth

JUNE 9, 2025

Distribution of Job Growth Isn’t Great The composition of job growth across sectors also gave less cause for comfort. Compliance Case # 8051655.1_060925_C The post Market Commentary: S&P 500 Approaching All-Time High but US Economic Momentum Slowing appeared first on Carson Wealth.

Carson Wealth

NOVEMBER 3, 2022

Use a qualified charitable distribution (QCD) from your individual retirement account (IRA). If you are age 70 ½ or older, you can transfer money from your IRA to a charity as a qualified charitable distribution (QCD), which makes it tax-free up to $100,000 ($200,000 if you file jointly).

Harness Wealth

MAY 14, 2025

The Co-op model is particularly attractive to those who value community involvement, equitable profit distribution, and shared responsibility. Second, Co-ops operate on a not-for-profit basis in many cases, meaning profits are either reinvested into the business or distributed back to members as patronage dividends.

Diamond Consultants

JULY 7, 2025

This is problematic in an environment where just the cost of technology and compliance can be staggering for even the most profitable of firms. Scenario 3: UBS Achieves Scale Through Acquisition UBS could make a strategic acquisition to gain scale, resources, and distribution in the U.S.

WiserAdvisor

AUGUST 31, 2023

To ensure your assets are distributed per your wishes, estate planning is essential. With proper estate planning, you can ensure that your assets are distributed to your rightful heirs without legal hassles. A financial advisor can help you navigate RMDs, ensuring compliance with the Internal Revenue Service (IRS) rules.

Harness Wealth

MAY 19, 2025

This means the corporation itself pays taxes on earnings before any dividends are distributed to shareholders, who then pay taxes on those dividends, resulting in what is often called “double taxation.” Understanding the tax filing requirements and payment schedules is essential for compliance and effective tax planning.

Harness Wealth

MAY 8, 2025

Whether you are contemplating forming an LP or already operate one, gaining clarity on tax matters can optimize your financial outcomes and ensure compliance with state and federal regulations. LPs are governed by a partnership agreement that outlines the roles, responsibilities, profit distribution, and other operational details.

Truemind Capital

MARCH 6, 2024

RIAs are also subjected to higher qualifications, minimum relevant experience, repeated certifications, infrastructure requirements, accountability regarding the suitability of advice, and adherence to other Sebi compliances. This results in higher transparency, reliability, answerability, and better value addition.

Harness Wealth

MAY 7, 2025

The ability to customize the partnership agreement allows partners to define roles, responsibilities, and profit distribution in a way that best fits their needs. Timely and accurate filing of these forms is crucial to avoid penalties and ensure compliance. This means the business itself does not pay income taxes.

Harness Wealth

MAY 7, 2025

The ability to customize the partnership agreement allows partners to define roles, responsibilities, and profit distribution in a way that best fits their needs. Timely and accurate filing of these forms is crucial to avoid penalties and ensure compliance. This means the business itself does not pay income taxes.

Carson Wealth

NOVEMBER 20, 2023

We reviewed the items that make up core services ex housing — about 105 in the PCE data — and calculated the distribution of year-over-year price increases in three periods: December 2019, before the pandemic September 2022, near peak inflation September 2023, the most recent data The chart below shows how the distribution has evolved.

Trade Brains

SEPTEMBER 26, 2024

NSE also oversees compliance by its members and listed companies with relevant rules and regulations. DotEx International Limited distributes real-time market information. Regulatory compliance: Operating in a highly regulated industry, NSE must comply with strict legal and regulatory requirements.

Trade Brains

OCTOBER 23, 2024

Known for premium stationery products, the company leverages strategic partnerships with international brands, including exclusive distribution rights for Mitsubishi Pensils (Japan) and Besia (Taiwan), enhancing its market position. 487 crore in FY23 to Rs. 502 crore in FY24. 1,154 crore in FY23 to Rs. 1,745 crore in FY24.

WiserAdvisor

OCTOBER 9, 2023

While you may withdraw funds without early penalties, certain types of withdrawals, commonly referred to as distributions, are often mandatory and could be subject to taxation. Traditional IRAs generally require distributions that are taxed as ordinary income, while Roth IRAs offer tax-free distributions provided certain conditions are met.

Carson Wealth

MAY 6, 2024

To illustrate this, we reviewed all 178 categories within core PCE inflation and calculated the distribution of year-over-year inflation over different periods. Encouragingly, the distribution is narrowing once again. It’s clear how inflation broadened out in June 2022 relative to December 2019.

Harness Wealth

APRIL 30, 2025

Expert guidance helps ensure compliance while optimizing outcomes for all stakeholders. Charitable remainder trusts These present opportunities to combine exit planning with philanthropic goals, generating immediate tax deductions while providing income streams before final distribution to charities.

Trade Brains

SEPTEMBER 15, 2023

Upgradation, digitalization and compliance of Information Technology (IT). This would benefit the company in the following ways: Achieving a wider market position Optimal use of distribution network, sales force, manufacturing units, human resources, supply chain, research and training facilities.

SEI

AUGUST 2, 2022

Discussions covered a range of topics, including foundation operations, inflation and return expectations, processes for unspent distributions, asset allocation changes, and governance findings. Processes around unspent distributions were especially interesting, varying greatly among respondents. Not for Public Distribution.

Harness Wealth

MAY 2, 2025

Understanding these requirements is essential to maintaining compliance and avoiding penalties. LLCs that elect to be taxed as corporations face different tax rates and payment schedules, including potential corporate income tax and dividend taxation on shareholder distributions.

Harness Wealth

MAY 2, 2025

Understanding these requirements is essential to maintaining compliance and avoiding penalties. LLCs that elect to be taxed as corporations face different tax rates and payment schedules, including potential corporate income tax and dividend taxation on shareholder distributions.

Carson Wealth

MAY 30, 2025

can streamline the daily operation of your trust or foundation, leaving you or your hired advisors more time to spend on strategic investment and distribution decisions. Tracking giving and distributions. Ensuring compliance with applicable rules and regulations. Communicating with other donors and charities. Analyzing outcomes.

Indigo Marketing Agency

DECEMBER 17, 2024

Tailored distribution: Share your content across social media, email, and your blog to reach clients where they are. To ensure compliance: Know the Regulations: Stay updated on industry regulations and guidelines from bodies like the SEC and FINRA. Share tips, answer FAQs, or host webinarsall in under five minutes.

Sara Grillo

JULY 8, 2022

In addition to the investment management, we’re creating distribution plans for our retirees, or savings plans for those who aren’t there yet. Work on outstanding compliance tasks: 1 hour. Some days have more networking chats, some have more coaching calls, some have more compliance if I have blocks of time.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content