Investing in the Future: Budget 2024’s Impact on Financial Markets

International College of Financial Planning

FEBRUARY 3, 2024

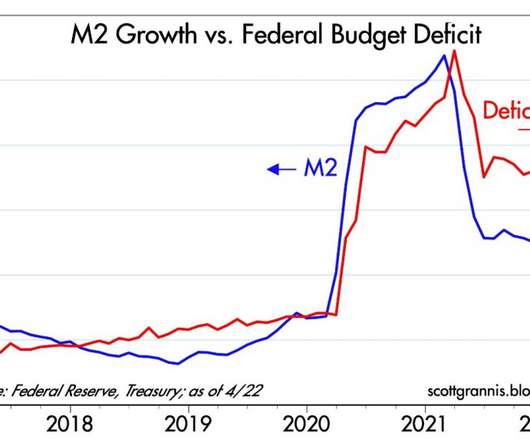

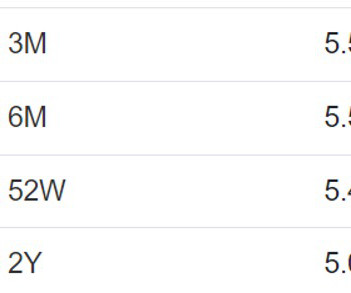

The decrease in government net borrowings is a positive sign, as it increases the availability of funds for the private sector at a cheaper lending rate, potentially boosting economic growth. Collectively, these measures signify a strategic approach to enhancing financial stability and supporting sustainable development.

Let's personalize your content