Are Financial Plans Getting Too Comprehensive: How The ‘Sledgehammer Of Value’ Isn’t Actually Paying Off

Nerd's Eye View

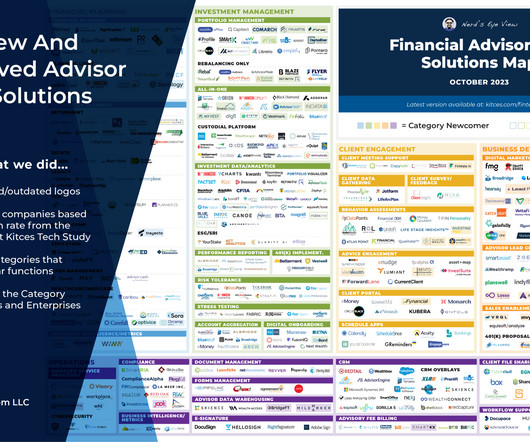

OCTOBER 23, 2023

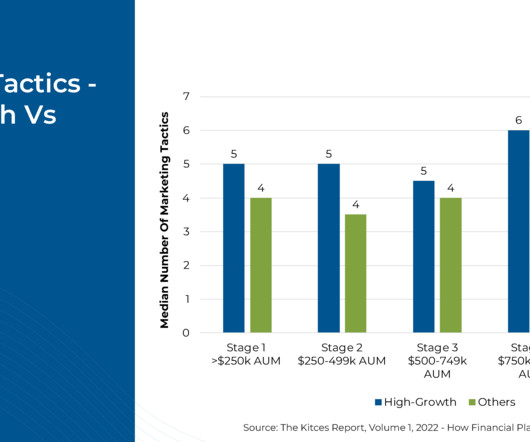

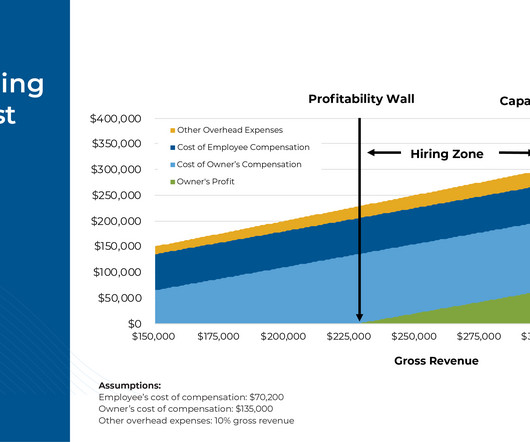

Many financial advisors take pride in the comprehensive nature of the advice they provide to clients and use the variety of services offered as a point of differentiation between themselves and other types of advisors. In addition, advisors could reduce the amount of time they spend on plan development by bringing on staff assistance (e.g.,

Let's personalize your content