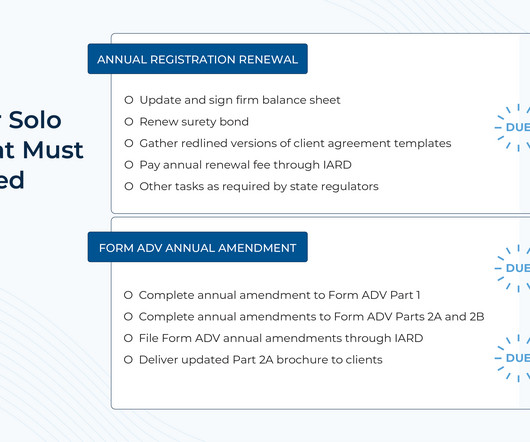

Compliance Calendar For A Solo RIA: Staying On Top Of Compliance Tasks While Serving Clients

Nerd's Eye View

APRIL 26, 2023

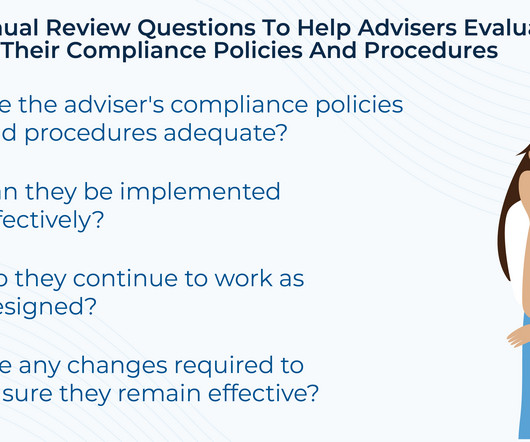

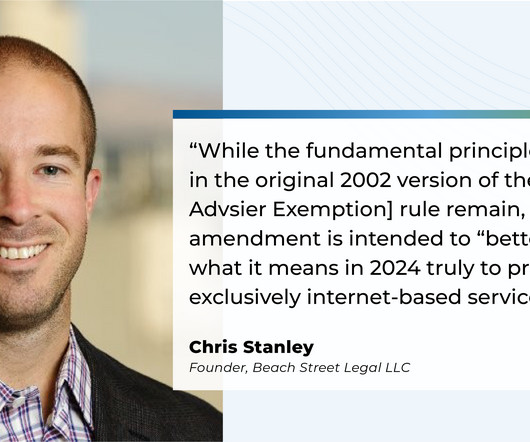

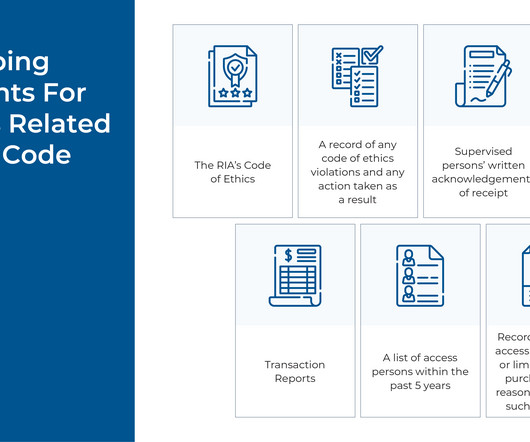

One of the most intimidating aspects of launching a solo advisory firm is the question of how to manage compliance. Creating a compliance calendar for a solo RIA can help to systematize and manage compliance tasks, requirements and deadlines. Read More.

Let's personalize your content