Compliance Calendar For A Solo RIA: Staying On Top Of Compliance Tasks While Serving Clients

Nerd's Eye View

APRIL 26, 2023

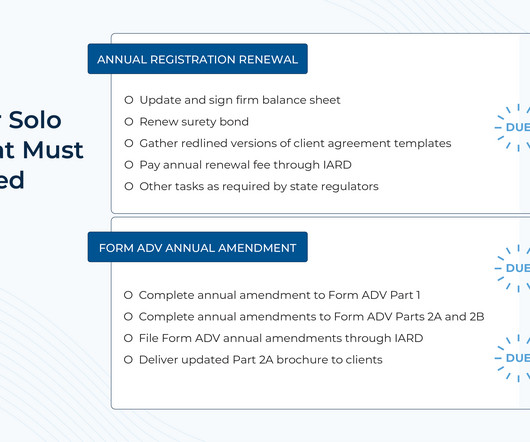

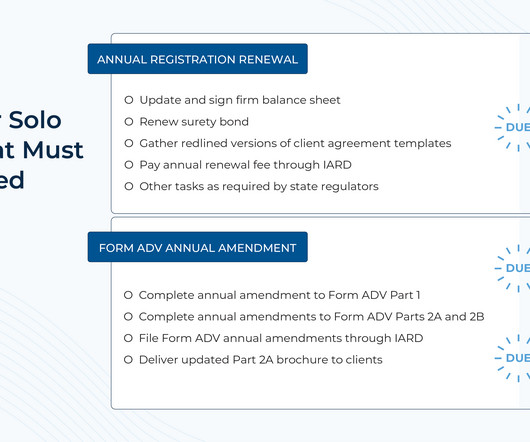

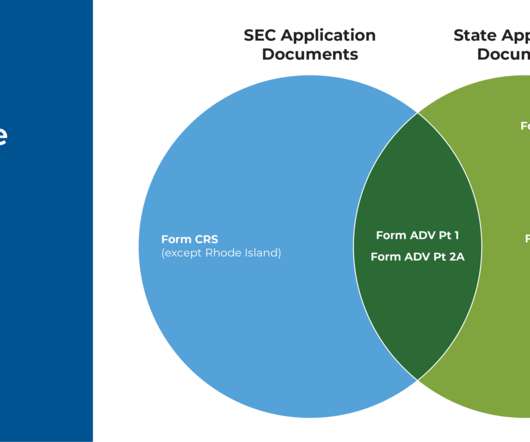

The 1st category of tasks that advisory firms must handle involves renewing their registration with the applicable state(s) in which they do business each year, which typically involves submitting select documents (e.g., Read More.

Let's personalize your content